Apple (AAPL)

264.18

-8.77 (-3.21%)

NASDAQ · Last Trade: Feb 28th, 5:47 PM EST

This asset management firm targets high-quality U.S. equities through a disciplined, valuation-driven investment approach.

Via The Motley Fool · February 28, 2026

One particular member of the "Magnificent Seven" is valued at a discount compared to its peers, but that could change swiftly.

Via The Motley Fool · February 28, 2026

Peter Thiel sold his positions in Apple and Microsoft in the fourth quarter.

Via The Motley Fool · February 28, 2026

Berkshire Hathaway will release its 2025 annual report and Greg Abel’s first CEO letter on Feb. 28.

Via Barchart.com · February 28, 2026

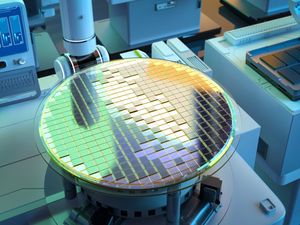

With data center fever gripping the world, which is the best single company to invest in to profit from it? Taiwan Semiconductor makes a compelling case for itself.

Via The Motley Fool · February 27, 2026

Buffett passed the reins to Greg Able as Berkshire's new CEO at the end of 2025 -- but not before making some big moves.

Via The Motley Fool · February 27, 2026

As of February 27, 2026, the U.S. Treasury market has entered a period of deceptive calm, with yields holding steady in a tight range as traders catch their breath following a month of volatile economic data. This "wait-and-see" approach reflects a broader strategic retreat by both bond and equity

Via MarketMinute · February 27, 2026

Following a week of intense market turbulence, BofA Securities (NASDAQ: NVDA) analyst Vivek Arya has issued a major price target upgrade for Nvidia Corp. (NASDAQ: NVDA) today, February 27, 2026. Raising the target from $275 to $300, Arya cited an "agentic AI inflection point" and overwhelming demand for the company’

Via MarketMinute · February 27, 2026

As the final reports of the fourth-quarter earnings season trickled in through late February 2026, the S&P 500 demonstrated a resilient performance that caught many analysts by surprise. The benchmark index recorded an 8.2% year-over-year increase in earnings per share (EPS), marking a significant milestone in a market

Via MarketMinute · February 27, 2026

In a dramatic departure from his historically cautious stance, Mike Wilson, Chief U.S. Equity Strategist at Morgan Stanley (NYSE: MS), has stunned Wall Street by raising the firm’s 12-month S&P 500 price target to a lofty 7,800. This projection, released as the market moves through the

Via MarketMinute · February 27, 2026

The global economic landscape stands at a precipice following a year of unprecedented trade hostilities between the world’s two largest economies. As of late February 2026, the era of "super-tariffs"—which saw reciprocal duties between the United States and China soar to 145% and 125% respectively—has reached a

Via MarketMinute · February 27, 2026

WASHINGTON D.C. — In a decision that has sent shockwaves through global supply chains and the halls of Congress, the United States Supreme Court ruled 6-3 on February 23, 2026, to strike down a central pillar of the Trump administration’s trade policy. The ruling, delivered in the consolidated cases

Via MarketMinute · February 27, 2026

In a move that fundamentally redraws the map of the global entertainment industry, Paramount Skydance Corporation (NASDAQ: PARA) and Warner Bros. Discovery (NASDAQ: WBD) officially announced a definitive merger agreement on February 27, 2026. The all-cash transaction, valued at approximately $111 billion including the assumption of debt, represents the largest

Via MarketMinute · February 27, 2026

NEW YORK — In a move that sent shockwaves through global trading floors on Friday, February 27, 2026, UBS (NYSE:UBS) officially downgraded its outlook on the U.S. stock market from “Overweight” to “Benchmark” (Neutral). The downgrade follows a staggering upside surprise in January’s Producer Price Index (PPI) data,

Via MarketMinute · February 27, 2026

This Vanguard ETF is built around industry leaders like Nvidia, Apple, and Microsoft.

Via The Motley Fool · February 27, 2026

JPMorgan Active Bond ETF is an actively managed fund targeting diversified fixed income exposure with a competitive dividend yield.

Via The Motley Fool · February 27, 2026

Shares of regional banking company Fulton Financial (NASDAQ:FULT) fell 5.1% in the afternoon session after the broader market slumped amid a surprisingly discouraging update on inflation.

Via StockStory · February 27, 2026

Shares of footwear and accessories discount retailer Designer Brands (NYSE:DBI)

fell 7.4% in the afternoon session after investor concerns grew over industry-wide pressures following a government report indicating rising costs. A report from the U.S. Bureau of Labor Statistics showed the Producer Price Index, which tracks costs for businesses, rose 0.5 percent in January. The data highlighted a jump in margins for apparel, footwear, and accessories retailing, signaling potential profit pressure for companies like Designer Brands.

Via StockStory · February 27, 2026

Shares of visual content marketplace Getty Images (NYSE:GETY) fell 5.9% in the afternoon session after the broader market sold off following a surprisingly high wholesale inflation report.

Via StockStory · February 27, 2026

The blockbuster 4.4% GDP growth recorded in the third quarter of 2025—a peak that many economists hailed as the "Goldilocks" moment for the American economy—has become a double-edged sword for investors in February 2026. While the growth showcased the immense power of the artificial intelligence investment cycle

Via MarketMinute · February 27, 2026

As the final reports of the Q4 2025 earnings season trickle in this late February, a familiar narrative has solidified: the American technology sector remains the undisputed engine of global equity markets. While the broader economy flirted with "no landing" scenarios throughout the year, the Information Technology and Communication Services

Via MarketMinute · February 27, 2026

All three major indexes are falling today, but not equally. Here's why the Dow is holding up better than its peers.

Via The Motley Fool · February 27, 2026

The United States labor market has entered a period of cautious stability in early 2026, characterized by a "low-hire, low-fire" equilibrium that has left economists and investors debating the difference between a successful soft landing and a period of prolonged stagnation. According to the latest data, weekly jobless claims fell

Via MarketMinute · February 27, 2026

The Federal Reserve concluded its first policy meeting of 2026 by electing to keep the federal funds rate unchanged at a target range of 3.50% to 3.75%. This "hawkish pause" follows a series of three consecutive rate cuts in late 2025, signaling a deliberate slowdown in the central

Via MarketMinute · February 27, 2026

Shares of genetic testing company Natera (NASDAQ:NTRA). fell 8.3% in the afternoon session after the release of a key inflation report revealed prices paid to U.S. producers rose more than anticipated in January.

Via StockStory · February 27, 2026