NVIDIA Corp (NVDA)

177.19

-7.70 (-4.16%)

NASDAQ · Last Trade: Feb 28th, 10:52 AM EST

Detailed Quote

| Previous Close | 184.89 |

|---|---|

| Open | 181.25 |

| Bid | 177.79 |

| Ask | 177.81 |

| Day's Range | 176.38 - 182.59 |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 311,781,891 |

| Market Cap | 4.31T |

| PE Ratio (TTM) | 36.16 |

| EPS (TTM) | 4.9 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 192,128,151 |

Chart

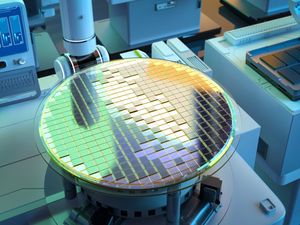

About NVIDIA Corp (NVDA)

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

Nvidia is on one of the fastest growth trajectories that the market has seen.

Via The Motley Fool · February 28, 2026

Investors might be underestimating AMD.

Via The Motley Fool · February 28, 2026

Nvidia reported stellar revenue, earnings, and guidance in its latest report.

Via The Motley Fool · February 28, 2026

Brookfield Renewable has powerful total return potential.

Via The Motley Fool · February 28, 2026

Retail investors talked up five hot stocks this week (Feb. 23 to Feb. 27) on X and Reddit's r/WallStreetBets: NVDA, NFLX, AMD, PLTR, CRM.

Via Benzinga · February 28, 2026

MarketBeat Week in Review – 02/23 - 02/27marketbeat.com

Sometimes the best offense is a good defense. That’s what investors seem to be feeling. Technology stocks continue to be under pressure, and that money is flowing into traditionally defensive assets like gold, but there’s increased evidence that this rotation is expanding to include many blue-chip stocks. For example, The Coca-Cola Co. (NYSE: KO) stock is up more than 10% in February.

Via MarketBeat · February 28, 2026

Here are two key topics on the earnings call that investors should know about.

Via The Motley Fool · February 28, 2026

Benzinga examined the prospects for many investors' favorite stocks over the last week — here's a look at some of our top stories.

Via Benzinga · February 28, 2026

An exchange-traded fund can save investors from picking winners and losers in complex industries like artificial intelligence.

Via The Motley Fool · February 28, 2026

Huang offers investors a glimpse of what's just ahead and farther down the road.

Via The Motley Fool · February 28, 2026

Most Wall Street analysts think Nvidia and Robinhood are deeply undervalued at current prices.

Via The Motley Fool · February 28, 2026

Gene Munster said Nvidia shares are sliding despite blowout earnings and record revenue as investors shift focus to 2027 growth concerns, even as AI infrastructure demand remains strong and Goldman Sachs reiterates its bullish stance.

Via Benzinga · February 28, 2026

The stock's sell-off looks more tied to spending fears than weakening demand.

Via The Motley Fool · February 27, 2026

2 Reasons Why Stocks Could Crash Under Trump in 2026fool.com

Macroeconomic uncertainty is rising, and it could have negative impacts on stock market performance.

Via The Motley Fool · February 27, 2026

With data center fever gripping the world, which is the best single company to invest in to profit from it? Taiwan Semiconductor makes a compelling case for itself.

Via The Motley Fool · February 27, 2026

Artificial intelligence is supercharging DigitalOcean's business.

Via The Motley Fool · February 27, 2026

Via MarketBeat · February 27, 2026

Hotter-than-expected inflation data, continued AI jitters, and potential private credit contagion rattle markets, today, Feb. 27, 2026.

Via The Motley Fool · February 27, 2026

The final trading week of February 2026 has laid bare a striking fracture in the U.S. equity markets. While the technology sector continues to feast on a relentless AI-driven "execution" cycle, the broader market indices are increasingly weighed down by deep-seated structural issues in the healthcare and industrial sectors.

Via MarketMinute · February 27, 2026

It's hard to say HVAC is boring when the stock price has soared more than tenfold over the last three years.

Via The Motley Fool · February 27, 2026

Wall Street weighs surging AI demand against widening losses and massive data center spending plans, today, Feb. 27, 2026.

Via The Motley Fool · February 27, 2026

As of February 27, 2026, the U.S. Treasury market has entered a period of deceptive calm, with yields holding steady in a tight range as traders catch their breath following a month of volatile economic data. This "wait-and-see" approach reflects a broader strategic retreat by both bond and equity

Via MarketMinute · February 27, 2026

Dan Ives, managing director at Wedbush Securities, said on Friday in an interview with CNBC that the software stocks under pressure may be at a turning point.

Via Stocktwits · February 27, 2026

In a move that underscores the relentless momentum of the artificial intelligence infrastructure trade, major Wall Street analysts have issued a series of significant upgrades for Super Micro Computer (Nasdaq: SMCI), citing the company's pole position in the "industrialization" phase of AI. Following a robust second-quarter earnings beat for fiscal

Via MarketMinute · February 27, 2026

Following a week of intense market turbulence, BofA Securities (NASDAQ: NVDA) analyst Vivek Arya has issued a major price target upgrade for Nvidia Corp. (NASDAQ: NVDA) today, February 27, 2026. Raising the target from $275 to $300, Arya cited an "agentic AI inflection point" and overwhelming demand for the company’

Via MarketMinute · February 27, 2026