News

Institutional credit investors are more worried about an AI bubble than about AI destroying other companies.

Via The Motley Fool · March 5, 2026

As of today, March 5, 2026, Broadcom Inc. (NASDAQ: AVGO) stands at the undisputed epicenter of the global artificial intelligence infrastructure. While Nvidia (NASDAQ: NVDA) captured the early headlines of the generative AI revolution with its H100 and Blackwell GPUs, Broadcom has quietly become the "architect of the back-end." By providing the high-speed networking switches [...]

Via Finterra · March 5, 2026

As of March 5, 2026, Robinhood Markets, Inc. (NASDAQ: HOOD) has officially shed its reputation as a mere "meme stock" gateway, evolving into a diversified global financial powerhouse. Once defined by the volatility of the 2021 retail trading frenzy, Robinhood has spent the last two years executing a rigorous strategic pivot. Today, the company stands [...]

Via Finterra · March 5, 2026

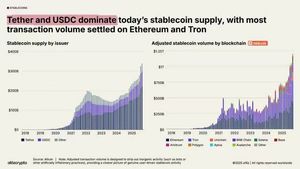

The digital asset landscape witnessed a significant resurgence on March 5, 2026, as Bitcoin (BTC) reclaimed the $73,000 level, sparking a broad market rally. At the center of this optimism is Coinbase Global, Inc. (NASDAQ: COIN), which saw its shares surge 14.6% in a single session. Once viewed merely as a volatile retail brokerage, the [...]

Via Finterra · March 5, 2026

The precious metals sector has staged a remarkable rally in early March 2026, as the PHLX Gold/Silver Sector Index (XAU) tests historic highs amid a massive influx of institutional capital. Driven by a significant decline in inflation-adjusted "real" yields, investors have aggressively rotated into gold-backed assets, resulting in over

Via MarketMinute · March 5, 2026

Explore how each ETF’s unique mix of holdings and risk profile can impact your approach to short-term fixed-income investing.

Via The Motley Fool · March 5, 2026

As the first quarter of 2026 unfolds, the gold mining sector has transformed from a traditional defensive harbor into a high-octane engine for portfolio growth. With spot gold prices surging toward the $6,300 per ounce mark, the industry’s heavyweights are witnessing a fundamental re-rating. Recent research notes from

Via MarketMinute · March 5, 2026

The global financial landscape has been thrown into a state of high-intensity volatility following the commencement of a massive, coordinated military campaign by the United States and Israel against Iranian strategic targets. As of today, March 5, 2026, the geopolitical landscape has shifted fundamentally, sending shockwaves through commodity pits and

Via MarketMinute · March 5, 2026

As the semiconductor growth story rolls on in 2026, the biggest question is whether investors are paying too much for current growth.

Via The Motley Fool · March 5, 2026

U.S. West Texas Intermediate crude futures maturing in April soared nearly 5% on Thursday, rising to $78.36 per barrel.

Via Stocktwits · March 5, 2026

Explore how these two ultra-low-risk bond ETFs differ in strategy, risk, and potential fit for your income portfolio.

Via The Motley Fool · March 5, 2026

As Newmont has outperformed its industry peers recently, analysts remain highly optimistic about the stock’s prospects.

Via Barchart.com · March 5, 2026

Total stock market funds make some of the best long-term investments. Here are three that combine broad coverage and ultra-low fees.

Via The Motley Fool · March 5, 2026

Search for the latest press releases from publicly traded companies, private corporations, non-profits and other public sector organizations.

Via NewMediaWire · March 5, 2026

Bitcoin (CRYPTO: BTC) is outperformed gold for the first time in months, surging 12% since Friday while gold fell 2% as investors poured nearly $700 million into U.S.

Via Benzinga · March 5, 2026

American Electric is outperforming the utilities sector lately, and analysts remain moderately optimistic about the stock’s outlook.

Via Barchart.com · March 5, 2026

Bitcoin is holding on to $73,000 amid strong institutional demand as liquidations stand at $472.88 million over the past 24 hours. Bitcoin ETFs saw $155.2 million in net inflows on Wednesday, while Ethereum ETFs reported $130 million in net inflows.

Via Benzinga · March 5, 2026

Block has outperformed other software stocks over the past year, and analysts remain somewhat optimistic about the stock’s growth potential.

Via Barchart.com · March 5, 2026

Norfolk Southern has outperformed the Transportation industry over the past year, but analysts are cautious about the stock’s prospects.

Via Barchart.com · March 5, 2026

If it sounds too good to be true, it probably is.

Via The Motley Fool · March 5, 2026

Although Simon Property has underperformed relative to its peers over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

Via Barchart.com · March 5, 2026

Tensions in the Middle East continued to rise after the U.S. sank the Iranian frigate Dena in international waters in the Indian Ocean.

Via Stocktwits · March 5, 2026

According to analyst Ted Pillows, if Bitcoin’s price remains above $70,000, there’s a “decent chance” of another rally.

Via Stocktwits · March 5, 2026

New York, USA, March 5, 2026 -- More than a decade ago, Bitcoin was still a niche experiment within a small circle of technologists.

Via Press Release Distribution Service · March 5, 2026

While recent performance trails the sector, Copart continues to command steady analyst support and long-term market relevance.

Via Barchart.com · March 5, 2026