SPDR S&P 500 ETF Trust (SPY)

685.99

-3.31 (-0.48%)

NYSE · Last Trade: Feb 28th, 7:16 PM EST

Detailed Quote

| Previous Close | 689.30 |

|---|---|

| Open | 683.09 |

| Day's Range | 681.64 - 686.86 |

| 52 Week Range | 69.00 - 697.84 |

| Volume | 83,308,869 |

| Market Cap | 7.27B |

| Dividend & Yield | 7.972 (1.16%) |

| 1 Month Average Volume | 85,153,694 |

Chart

News & Press Releases

In an article on his website posted on Friday, Deepwater Management founder Gene Munster said that the drop in Nvidia shares is because accelerating revenue growth is no longer a catalyst for the company.

Via Stocktwits · February 27, 2026

According to a report from CNBC, the president said to reporters outside the White House that while he would prefer to not attack Iran, but may have to.

Via Stocktwits · February 27, 2026

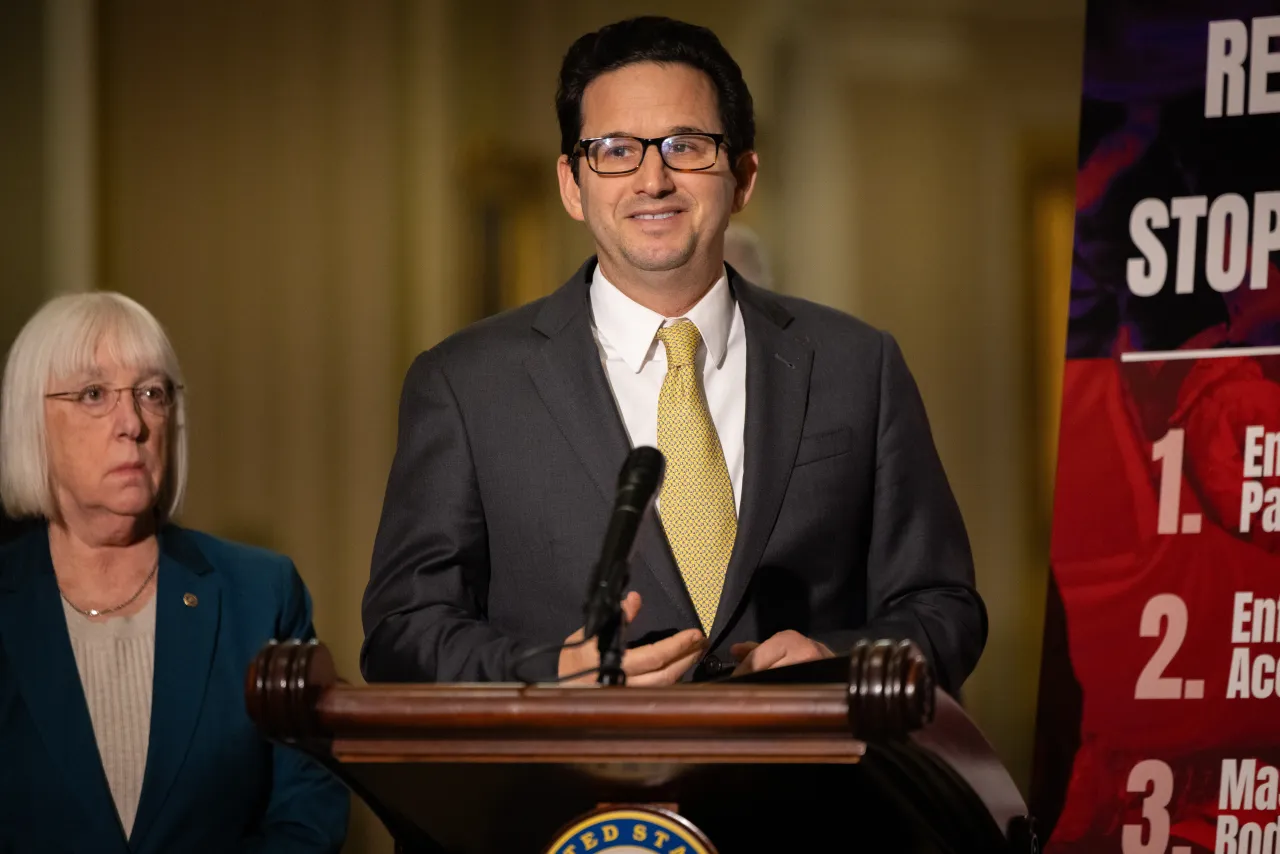

According to an Axios report, the Hawaii Democrat plans to reveal two separate measures in the months ahead designed to address labor market risks linked to AI adoption.

Via Stocktwits · February 27, 2026

Despite blowout results, Nvidia stock had dropped 5.6% on Thursday.

Via Stocktwits · February 27, 2026

Mass layoffs have already ignited a debate over whether Block’s reset is AI-driven efficiency or a COVID hiring hangover.

Via Stocktwits · February 27, 2026

The week saw Joby beat Wall Street expectations for fourth-quarter revenue and reported a smaller-than-expected loss as production ramped up, pushing shares up.

Via Stocktwits · February 27, 2026

Data from Stocktwits showed that retail sentiment on SPY has moved to ‘bullish’, while it remained ‘bearish’ on QQQ.

Via Stocktwits · February 27, 2026

RKLB pitches orbiting data centers powered by silicon solar tech, lifting retail sentiment, even as investors brace for another potential Neutron delay.

Via Stocktwits · February 27, 2026

IDC forecasts a staggering 13% drop in smartphone shipments in 2026, weighed by memory chip shortages and rising phone prices.

Via Stocktwits · February 27, 2026

Anthropic is pushing back against government demands for broad military access to its AI systems, a stance that could steer some federal AI business towards rivals such as Palantir.

Via Stocktwits · February 27, 2026

While Jack Dorsey defends the move to lay off people as a necessity of the current times, users on Stocktwits and X are raising concerns about the job cuts.

Via Stocktwits · February 27, 2026

PSKY shares could remain highly volatile in the near term as Warner Bros. Discovery formally decides on its offer and the deal enters a regulatory review.

Via Stocktwits · February 27, 2026

As the company focuses on growing its user base, Duolingo expects to have an impact in the short term, mainly on its profitability.

Via Stocktwits · February 26, 2026

U.S. stock futures moved lower late Thursday as Nvidia’s 5.5% post-earnings drop weighed on semiconductor stocks.

Via Stocktwits · February 26, 2026

The S&P 500 Index climbed toward a historic psychological threshold on Thursday, closing at 6,946.13 as investors shook off early-year volatility to chase the next major market milestone. The 0.8% daily gain reflects a resilient appetite for equities, driven by a "second wave" of artificial intelligence

Via MarketMinute · February 26, 2026

The financial landscape of early 2026 has been defined by a definitive "Great Rotation," as investors aggressively pivot away from the mega-cap technology giants that dominated the previous decade in favor of long-neglected small-cap stocks. In a dramatic reversal of the "Magnificent Seven" era, the Russell 2000 Index (NYSE: IWM)

Via MarketMinute · February 26, 2026

The U.S. labor market continues to display a startling durability that has left many economists recalibrating their recession models. According to data released by the Department of Labor on February 26, 2026, initial jobless claims for the week ending February 21 fell to 227,000, representing a decrease of

Via MarketMinute · February 26, 2026

Burry pointed out that there has been a surge in Nvidia’s purchase obligations, which rose to $95.2 billion at the end of the fourth quarter, compared to $16.1 billion a year ago.

Via Stocktwits · February 26, 2026

The economist added that the Federal Open Market Committee’s structure makes it susceptible to groupthink and that the institution has experienced mission creep.

Via Stocktwits · February 26, 2026

Sales in Nvidia’s networking division grew faster than both its broader data center segment and the company’s overall revenue growth.

Via Stocktwits · February 26, 2026

Data from Stocktwits showed that retail sentiment on SPY and QQQ diverged.

Via Stocktwits · February 26, 2026

Earlier in the year, investors cheered SMR stock based on DOE’s $2.7 billion commitment to strengthen the uranium supply chain.

Via Stocktwits · February 26, 2026

Nvidia insider trades in the last two years have almost exclusively been sales.

Via Stocktwits · February 26, 2026

MELI stock was battered on Wednesday, even after better-than-expected revenue, as a profit miss weighed on investor sentiment.

Via Stocktwits · February 25, 2026

Investors are optimistic about Joby’s growth prospects as FAA certification ramps up and the company prepares to fly its first passengers this year.

Via Stocktwits · February 25, 2026