The Central and Eastern Europe Fund, Inc. (CEE)

19.53

+0.00 (0.00%)

NYSE · Last Trade: Mar 2nd, 8:59 AM EST

Detailed Quote

| Previous Close | 19.53 |

|---|---|

| Open | - |

| Bid | 19.03 |

| Ask | 19.85 |

| Day's Range | N/A - N/A |

| 52 Week Range | 11.20 - 19.98 |

| Volume | 20 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 0.3870 (1.98%) |

| 1 Month Average Volume | 21,965 |

Chart

News & Press Releases

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The New Germany Fund, Inc. (NYSE: GF) and The European Equity Fund, Inc. (NYSE: EEA) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors declared the distributions set forth below. Each Fund’s total distributions will be paid in stock except that any stockholder of record as of December 30, 2025, may elect to receive such distribution in cash.

By DWS · Via Business Wire · December 18, 2025

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The European Equity Fund, Inc. (NYSE: EEA), and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors has approved an extension of the current repurchase authorization permitting open market share repurchases for an additional twelve-month period. Each Fund may continue to purchase outstanding shares of its common stock in open-market transactions over the twelve-month period from August 1, 2025 through July 31, 2026 when the Fund’s shares trade at a discount to net asset value (“NAV”) and such purchases are deemed to be in the best interests of the Fund. The amount and timing of the repurchases will be at the discretion of DWS Investment Management Americas, Inc., the Funds’ administrator, and subject to market conditions and investment considerations. Any purchases will be made at prices that will be accretive to each Fund’s NAV.

By DWS · Via Business Wire · July 25, 2025

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”) announced today the results of its Annual Meeting of Stockholders held on June 30, 2025.

By DWS · Via Business Wire · June 30, 2025

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and, collectively, the “Funds”) announced today that the Annual Meeting of Stockholders for each Fund will be held at 10:30 a.m., Eastern time on June 30, 2025 at the offices of DWS Investment Management Americas, Inc., 875 Third Avenue, New York, New York 10022. Holders of shares of common stock of record of the Funds at the close of business on May 16, 2025 are entitled to vote at the meeting and any postponements or adjournments thereof. At the meeting, stockholders of each Fund will consider the election of Directors and approval of auditors. Stockholder of CEE will also be asked to consider, if properly presented, a stockholder proposal.

By DWS · Via Business Wire · April 22, 2025

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The New Germany Fund, Inc. (NYSE: GF) and The European Equity Fund, Inc. (NYSE: EEA) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors declared the distributions set forth below. CEE’s and EEA’s total distributions will be paid in stock except that any stockholder of record as of December 30, 2024 may elect to receive such distribution in cash. GF’s total distributions will be paid in cash to the stockholders of record as of December 30, 2024.

By DWS · Via Business Wire · December 18, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”). As previously reported, certain of the Fund’s Russian holdings have been valued at zero since March 14, 2022 in light of measures adopted by the Russian Central Bank and Government, as well as sanctions implemented by the United States and other countries in response to Russia’s invasion of Ukraine. The effects of the sanctions and measures adopted by the Russian Central Bank and Government are far-reaching and include, among others, the freezing of certain Russian assets held by entities, such as the Fund, that are organized in countries viewed as “unfriendly” by the Russian Government.

By DWS · Via Business Wire · November 21, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”). As previously reported, certain of the Fund’s Russian holdings have been valued at zero since March 14, 2022 in light of measures adopted by the Russian Central Bank and Government, as well as sanctions implemented by the United States and other countries in response to Russia’s invasion of Ukraine. The effects of the sanctions and measures adopted by the Russian Central Bank and Government are far-reaching and include, among others, the freezing of certain Russian assets held by entities, such as the Fund, that are organized in countries viewed as “unfriendly” by the Russian Government.

By DWS · Via Business Wire · September 26, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The European Equity Fund, Inc. (NYSE: EEA), and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors has approved an extension of the current repurchase authorization permitting open market share repurchase program for an additional twelve-month period. Each Fund may continue to purchase outstanding shares of its common stock in open-market transactions over the twelve-month period from August 1, 2024 through July 31, 2025 when the Fund’s shares trade at a discount to net asset value (“NAV”) and such purchases are deemed to be in the best interests of the Fund. The amount and timing of the repurchases will be at the discretion of DWS Investment Management Americas, Inc., the Funds’ administrator, and subject to market conditions and investment considerations. Purchases will be made at prices that will be accretive to each Fund’s NAV.

By DWS Investment Management Americas, Inc. · Via Business Wire · July 25, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”) announced today the results of its Annual Meeting of Stockholders which was initially called to order and adjourned on June 27, 2024 and reconvened on July 19, 2024.

By DWS · Via Business Wire · July 19, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”) announced today the results of its Annual Meeting of Stockholders held on June 27, 2024.

By DWS · Via Business Wire · June 27, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”). As previously reported, the Fund’s Russian holdings have been valued at zero since March 14, 2022 in light of measures adopted by the Russian Central Bank and Government, as well as sanctions implemented by the United States and other countries in response to Russia’s invasion of Ukraine. The effects of the sanctions and measures adopted by the Russian Central Bank and Government are far-reaching and include, among others, the freezing of certain Russian assets held by entities, such as the Fund, that are organized in countries viewed as “unfriendly” by the Russian Government. The Fund’s investment manager has been monitoring the situation closely and has observed occasional privately negotiated transactions in depositary receipts of non-sanctioned Russian issuers taking place (at prices that are deeply discounted from those taking place through the facilities of the Moscow Stock Exchange). In May 2024, the Fund was successful in selling depositary receipts of one non-sanctioned Russian issuer in such a privately negotiated transaction resulting in positive impact to the Fund’s net asset value.

By DWS · Via Business Wire · May 30, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and, collectively, the “Funds”) announced today that the Annual Meeting of Stockholders for each Fund will be held at 10:00 a.m., Eastern time on June 27, 2024 at the offices of DWS Investment Management Americas, Inc., 875 Third Avenue, New York, New York 10022. Holders of shares of common stock of record of the Funds at the close of business on May 2, 2024 are entitled to vote at the meeting and any postponements or adjournments thereof. At the meeting, stockholders of each Fund will consider the election of Directors and approval of auditors.

By DWS · Via Business Wire · April 19, 2024

Companies Reporting Before The Bell • Creative Realities (NASDAQ:CREX) is expected to report quarterly earnings at $0.02 per share on revenue of $16.47 million.

Via Benzinga · March 21, 2024

Endeavour appointed Ian Cockerill, the Deputy Chairman, as the new CEO, effective immediately.

Via Benzinga · January 5, 2024

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The New Germany Fund, Inc. (NYSE: GF) and The European Equity Fund, Inc. (NYSE: EEA) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors declared the distributions set forth below. CEE’s and EEA’s total distributions will be paid in stock except that any stockholder of record as of December 29, 2023 may elect to receive such distribution in cash. GF’s total distributions will be paid in cash to the stockholders of record as of December 29, 2023.

By DWS · Via Business Wire · December 19, 2023

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The European Equity Fund, Inc. (NYSE: EEA) and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and collectively, the “Funds”) each announced today that, in connection with the previously announced retirements of Mr. Christian Strenger and Dr. Christopher Pleister from each Fund’s Board, the Board of Directors has appointed Mr. Bernhard Koepp, Independent Director of each Fund, to succeed Mr. Christian Strenger as the Chairman of each Fund’s Board effective January 1, 2024, rather than Mr. Walter C. Dostmann, as previously announced. Mr. Dostmann will continue to serve as a Director for the Funds.

By DWS · Via Business Wire · November 13, 2023

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The European Equity Fund, Inc. (NYSE: EEA), and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors has approved an extension of the current repurchase authorization permitting CEE, EEA, GF and to repurchase up to 630,039, 687,213 and 1,710,430 shares, respectively (representing approximately 10% of each Fund’s current shares outstanding) for the twelve month period from August 1, 2023 through July 31, 2024. Repurchases will be made from time to time when they are believed to be in the best interests of a Fund. Repurchases will not be made when a Fund’s shares are trading at a premium to net asset value, which is currently the case for the shares of CEE.

By DWS · Via Business Wire · July 28, 2023

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) (the “Fund”) announced today the results of its Annual Meeting of Stockholders held on June 22, 2023.

By DWS · Via Business Wire · June 22, 2023

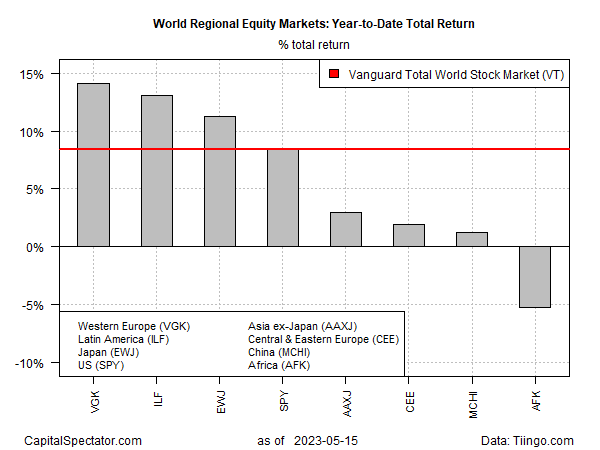

The dominance of the US stock market over its foreign counterparts has for years been taken as a sign of the new world order for global asset allocation that forever and always favors American shares.

Via Talk Markets · May 16, 2023

The Central and Eastern Europe Fund, Inc. (NYSE: CEE) and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and, collectively, the “Funds”) announced today that the Annual Meeting of Stockholders for each Fund will be held at 10:00 a.m., Eastern time on June 22, 2023 at the offices of DWS Investment Management Americas, Inc., 875 Third Avenue, New York, New York 10022. Holders of shares of common stock of record of the Funds at the close of business on April 28, 2023 are entitled to vote at the meeting and any postponements or adjournments thereof. At the meeting, stockholders of each Fund will consider the election of Directors and approval of auditors.

By DWS · Via Business Wire · April 17, 2023

The rally in foreign stocks so far in 2023 suggests the tide may finally be turning in favor of global investing strategies.

Via Talk Markets · February 14, 2023

The energy sector has been red-hot for much of the past year, but there are still pockets in this corner that remain battered, at least in relative terms.

Via Talk Markets · January 31, 2023

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The New Germany Fund, Inc. (NYSE: GF) and The European Equity Fund, Inc. (NYSE: EEA) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors declared the distributions set forth below. CEE’s and EEA’s total distributions will be paid in stock except that any stockholder of record as of December 30, 2022 may elect to receive such distribution in cash. GF’s total distributions will be paid in cash to the stockholders of record as of December 30, 2022.

By DWS · Via Business Wire · December 20, 2022

For most equity strategies diversified across global markets, this year’s results will be painful. Short of a dramatic run higher between now and the end of 2022, red ink will prevail. But when losses dominate it’s time to start looking for bargains.

Via Talk Markets · November 30, 2022

The Central and Eastern Europe Fund, Inc. (NYSE: CEE), The European Equity Fund, Inc. (NYSE: EEA), and The New Germany Fund, Inc. (NYSE: GF) (each, a “Fund,” and collectively, the “Funds”) each announced today that its Board of Directors has approved an extension of the current repurchase authorization permitting CEE, EEA, GF and to repurchase up to 622,066, 708,104 and 1,756,928 shares, respectively (representing approximately 10% of each Fund’s current shares outstanding) for the twelve month period from August 1, 2022 through July 31, 2023. Repurchases will be made from time to time when they are believed to be in the best interests of a Fund. Repurchases will not be made when a Fund’s shares are trading at a premium to net asset value, which is currently the case for the shares of CEE.

By DWS · Via Business Wire · July 29, 2022