Looking back on real estate services stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Cushman & Wakefield (NYSE:CWK) and its peers.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 12 real estate services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 0.9% above.

Thankfully, share prices of the companies have been resilient as they are up 9.6% on average since the latest earnings results.

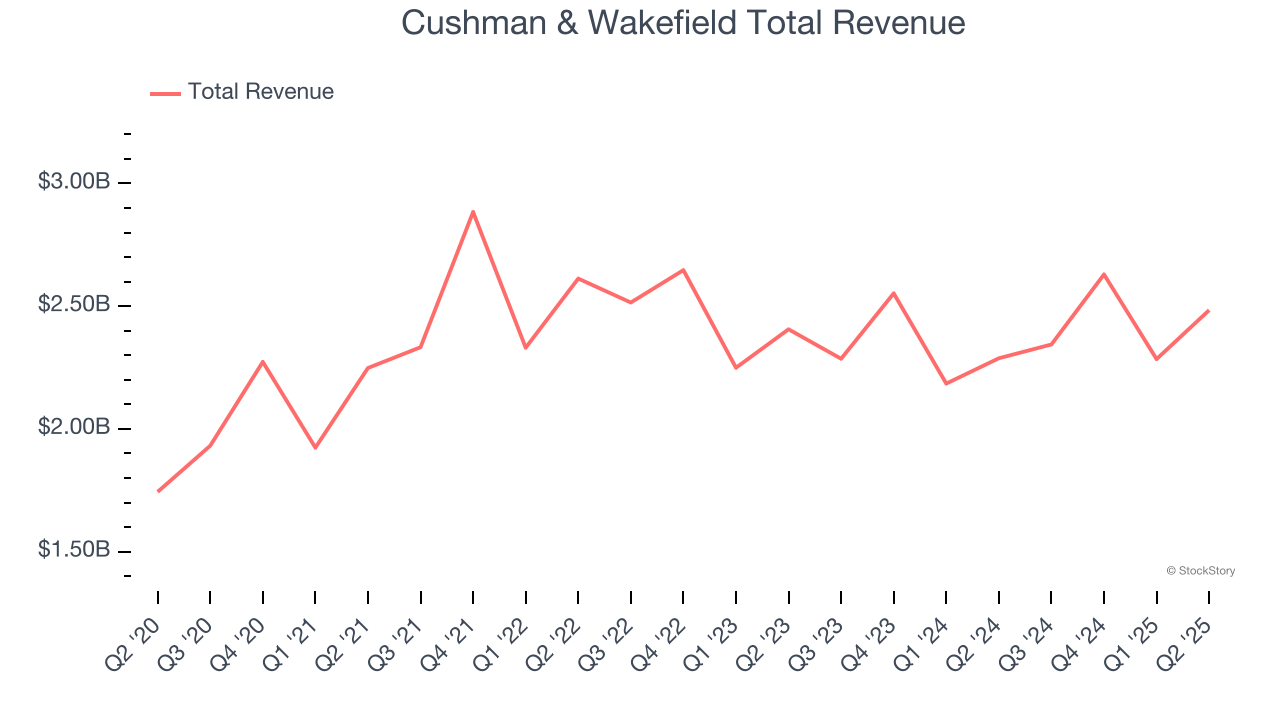

Cushman & Wakefield (NYSE:CWK)

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE:CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Cushman & Wakefield reported revenues of $2.48 billion, up 8.6% year on year. This print exceeded analysts’ expectations by 4.6%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

“Our second quarter results highlight the strong and resilient growth engine we have successfully built over the past two years. Capital markets revenue growth of 26% in the quarter underscores our solid market positioning and the early success of our expanded recruiting efforts. Leasing and Services revenue growth continued to exceed expectations as our teams consistently developed and executed compelling market opportunities for our clients. Through the first half of 2025, we achieved 95% adjusted earnings per share growth and are raising our earnings per share outlook for the full year. We also continue to focus on fortifying our balance sheet and this morning have announced an additional $150 million debt paydown,” said Michelle MacKay, Chief Executive Officer of Cushman & Wakefield.

Interestingly, the stock is up 20.2% since reporting and currently trades at $14.82.

Is now the time to buy Cushman & Wakefield? Access our full analysis of the earnings results here, it’s free.

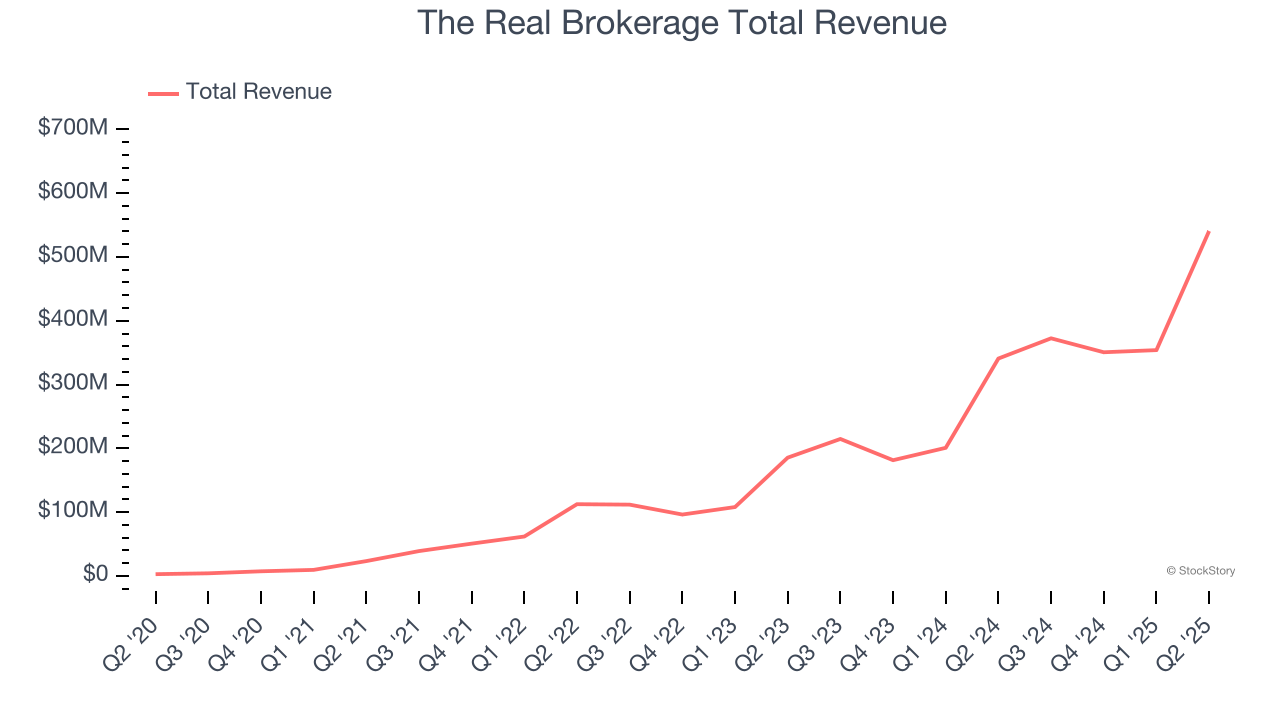

Best Q2: The Real Brokerage (NASDAQ:REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $540.7 million, up 58.7% year on year, outperforming analysts’ expectations by 12.1%. The business had a stunning quarter with EPS in line with analysts’ estimates and an impressive beat of analysts’ EBITDA estimates.

The Real Brokerage achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.1% since reporting. It currently trades at $4.48.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: eXp World (NASDAQ:EXPI)

Founded in 2009, eXp World (NASDAQ:EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

eXp World reported revenues of $1.31 billion, up 1.1% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 5.9% since the results and currently trades at $10.20.

Read our full analysis of eXp World’s results here.

CBRE (NYSE:CBRE)

Established in 1906, CBRE (NYSE:CBRE) is one of the largest commercial real estate services firms in the world.

CBRE reported revenues of $9.75 billion, up 16.2% year on year. This number topped analysts’ expectations by 4.3%. It was a very strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is up 8.5% since reporting and currently trades at $159.12.

Read our full, actionable report on CBRE here, it’s free.

Marcus & Millichap (NYSE:MMI)

Founded in 1971, Marcus & Millichap (NYSE:MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

Marcus & Millichap reported revenues of $172.3 million, up 8.8% year on year. This result beat analysts’ expectations by 5.3%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates.

The stock is down 4.4% since reporting and currently trades at $30.76.

Read our full, actionable report on Marcus & Millichap here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.