As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialized consumer services industry, including Frontdoor (NASDAQ:FTDR) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 10 specialized consumer services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.4% since the latest earnings results.

Frontdoor (NASDAQ:FTDR)

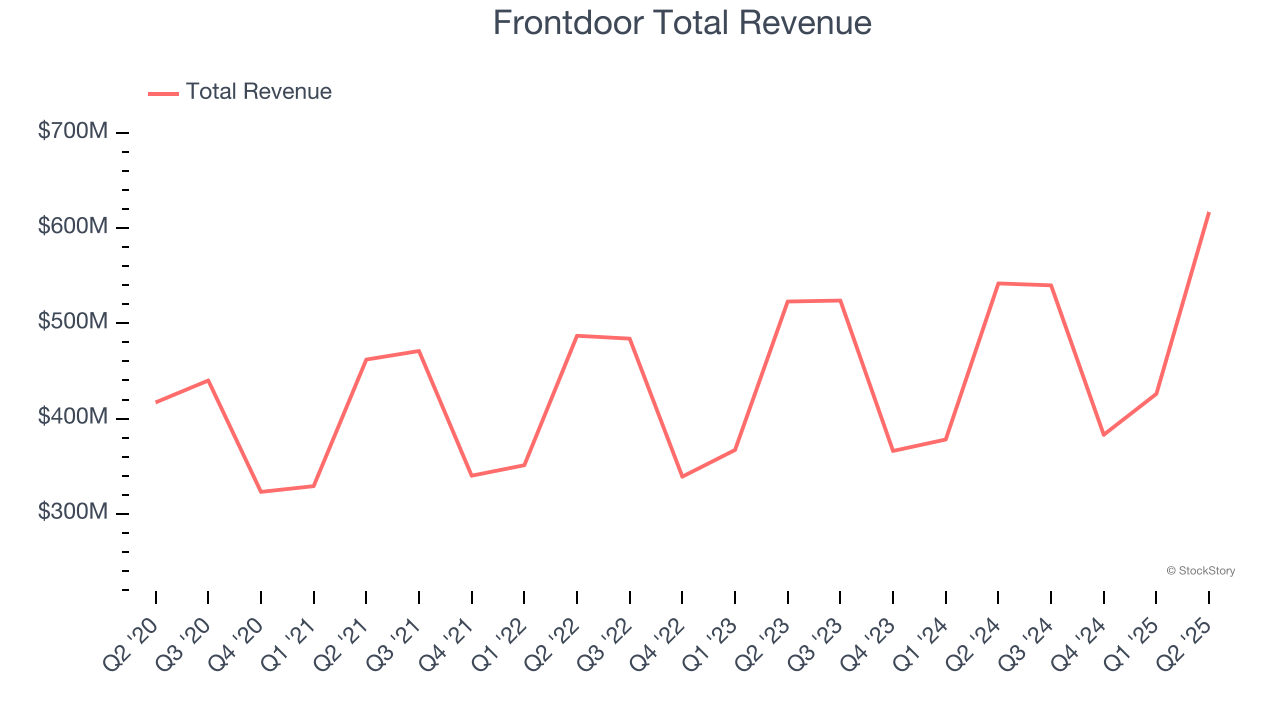

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $617 million, up 13.8% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

“Frontdoor continues to perform exceptionally well, and we delivered another quarter of outstanding financial performance," said Chairman and Chief Executive Officer Bill Cobb.

Frontdoor pulled off the fastest revenue growth of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $58.86.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free.

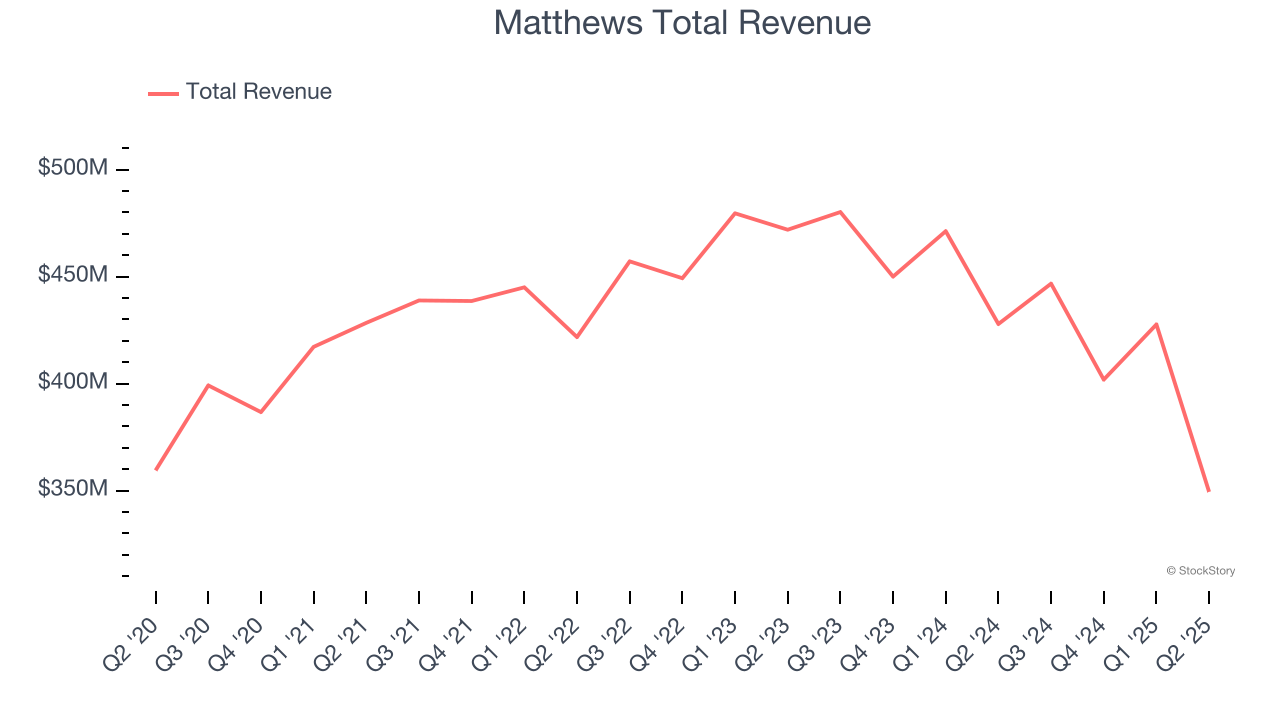

Best Q2: Matthews (NASDAQ:MATW)

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $349.4 million, down 18.3% year on year, outperforming analysts’ expectations by 8.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Matthews achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.2% since reporting. It currently trades at $23.52.

Is now the time to buy Matthews? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.64 billion, down 1.9% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 20.3% since the results and currently trades at $30.79.

Read our full analysis of LKQ’s results here.

Pool (NASDAQ:POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.78 billion, flat year on year. This result met analysts’ expectations. Zooming out, it was a mixed quarter as it underperformed in some other aspects of the business.

The stock is flat since reporting and currently trades at $315.38.

Read our full, actionable report on Pool here, it’s free.

ADT (NYSE:ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.29 billion, up 6.8% year on year. This number beat analysts’ expectations by 0.9%. More broadly, it was a mixed quarter as it also logged a beat of analysts’ EPS estimates but full-year revenue guidance meeting analysts’ expectations.

The stock is up 3.4% since reporting and currently trades at $8.72.

Read our full, actionable report on ADT here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.