CrowdStrike has been treading water for the past six months, recording a small loss of 4.4% while holding steady at $417. The stock also fell short of the S&P 500’s 4.7% gain during that period.

Is now the time to buy CRWD? Find out in our full research report, it’s free.

Why Does CrowdStrike Spark Debate?

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ:CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

Two Positive Attributes:

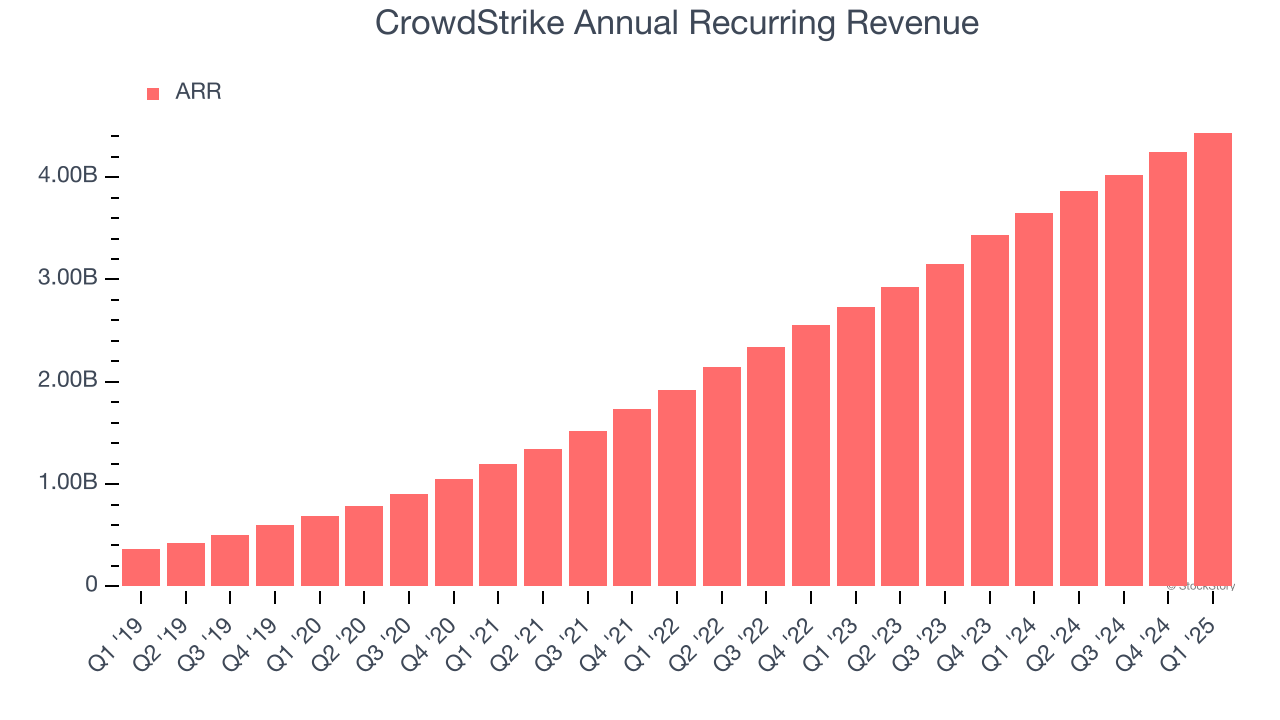

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

CrowdStrike’s ARR punched in at $4.44 billion in Q1, and over the last four quarters, its year-on-year growth averaged 26.1%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes CrowdStrike a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect CrowdStrike’s revenue to rise by 21.6%. While this projection is below its 36.2% annualized growth rate for the past three years, it is admirable and implies the market is forecasting success for its products and services.

One Reason to be Careful:

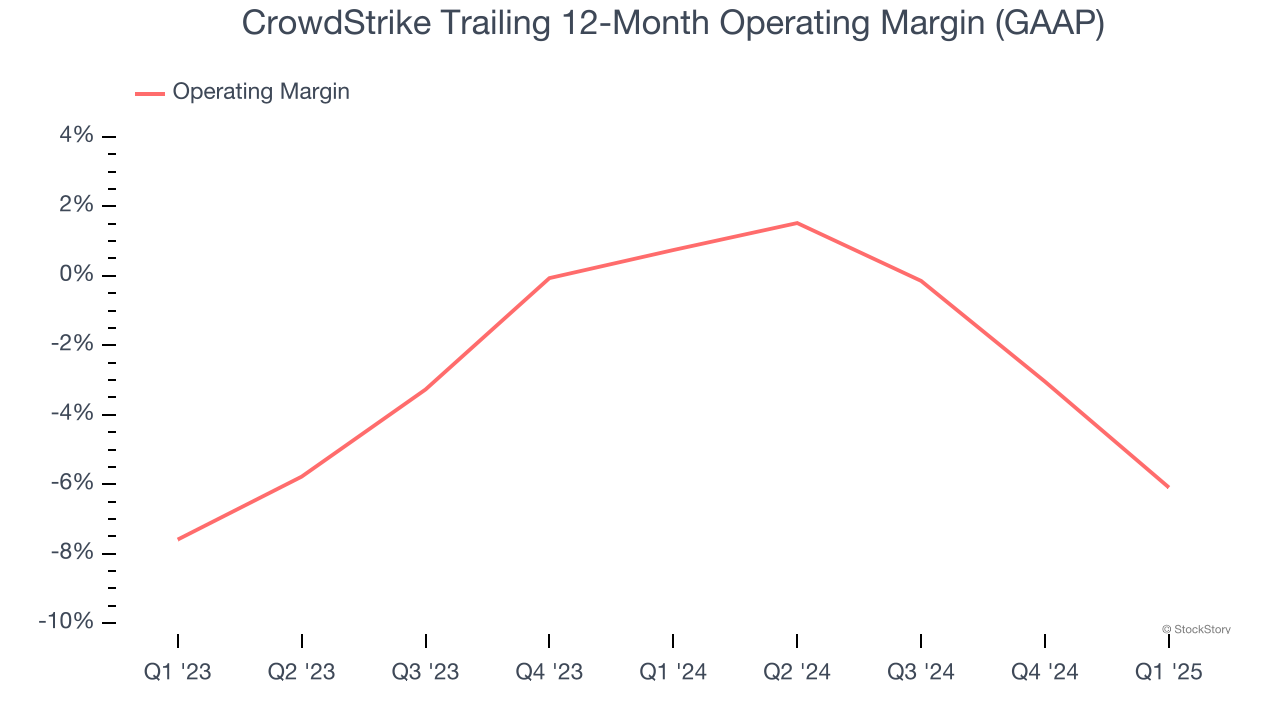

Shrinking Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, CrowdStrike’s operating margin decreased by 6.8 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. CrowdStrike’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 6.1%.

Final Judgment

CrowdStrike’s merits more than compensate for its flaws. With its shares lagging the market recently, the stock trades at 20.7× forward price-to-sales (or $417 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.