Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Vertiv (NYSE:VRT) and the best and worst performers in the electrical systems industry.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 11 electrical systems stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 2.9% below.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

Vertiv (NYSE:VRT)

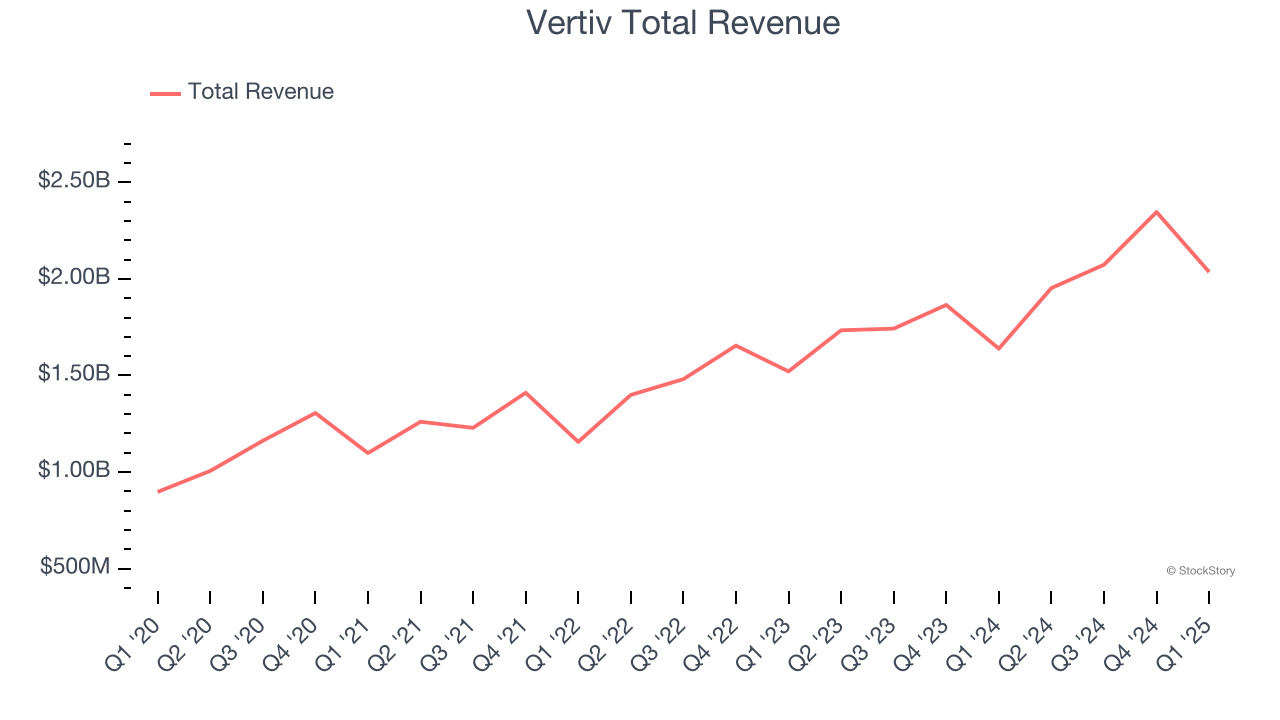

Formerly part of Emerson Electric, Vertiv (NYSE:VRT) manufactures and services infrastructure technology products for data centers and communication networks.

Vertiv reported revenues of $2.04 billion, up 24.2% year on year. This print exceeded analysts’ expectations by 5.2%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ organic revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

"Vertiv's strong first quarter results demonstrate our continued momentum and reinforce our position for long-term sustainable growth," said Giordano Albertazzi, Vertiv's Chief Executive Officer.

Vertiv pulled off the fastest revenue growth and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 43.6% since reporting and currently trades at $103.01.

Read why we think that Vertiv is one of the best electrical systems stocks, our full report is free.

Best Q1: Kimball Electronics (NASDAQ:KE)

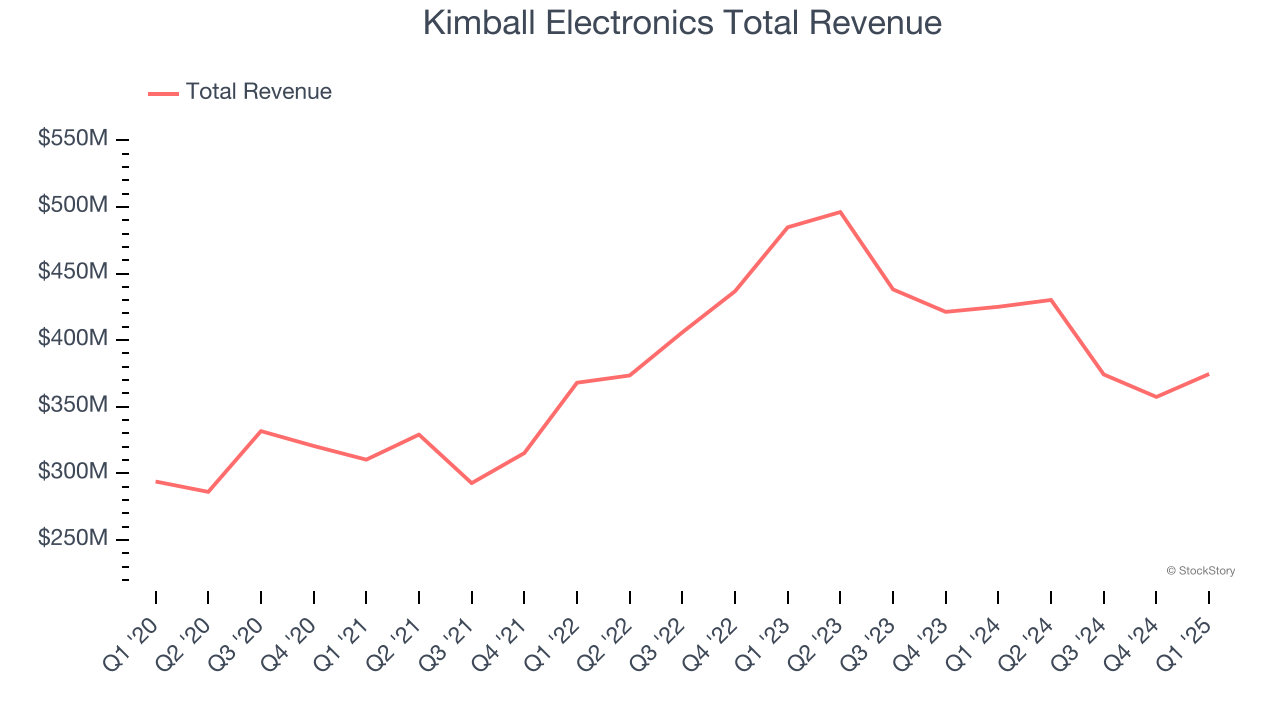

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

Kimball Electronics reported revenues of $374.6 million, down 11.9% year on year, outperforming analysts’ expectations by 10.8%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Kimball Electronics pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 16.9% since reporting. It currently trades at $17.22.

Is now the time to buy Kimball Electronics? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Whirlpool (NYSE:WHR)

Credited with introducing the first automatic washing machine, Whirlpool (NYSE:WHR) is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $3.62 billion, down 19.4% year on year, falling short of analysts’ expectations by 1%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

Whirlpool delivered the slowest revenue growth in the group. The stock is flat since the results and currently trades at $77.57.

Read our full analysis of Whirlpool’s results here.

LSI (NASDAQ:LYTS)

Enhancing commercial environments, LSI (NASDAQ:LYTS) provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $132.5 million, up 22.5% year on year. This print surpassed analysts’ expectations by 2.1%. Taking a step back, it was a softer quarter as it produced a miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $15.76.

Read our full, actionable report on LSI here, it’s free.

Hubbell (NYSE:HUBB)

A respected player in the electrical segment, Hubbell (NYSE:HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Hubbell reported revenues of $1.37 billion, down 2.4% year on year. This number lagged analysts' expectations by 1.3%. Overall, it was a slower quarter as it also recorded a significant miss of analysts’ EBITDA and EPS estimates.

The stock is up 5.4% since reporting and currently trades at $381.91.

Read our full, actionable report on Hubbell here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.