As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the hospital chains industry, including Tenet Healthcare (NYSE:THC) and its peers.

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

The 4 hospital chains stocks we track reported a satisfactory Q1. As a group, revenues were in line with analysts’ consensus estimates.

Luckily, hospital chains stocks have performed well with share prices up 14.9% on average since the latest earnings results.

Best Q1: Tenet Healthcare (NYSE:THC)

With a network spanning nine states and serving primarily urban and suburban communities, Tenet Healthcare (NYSE:THC) operates a nationwide network of hospitals, ambulatory surgery centers, and outpatient facilities providing acute care and specialty healthcare services.

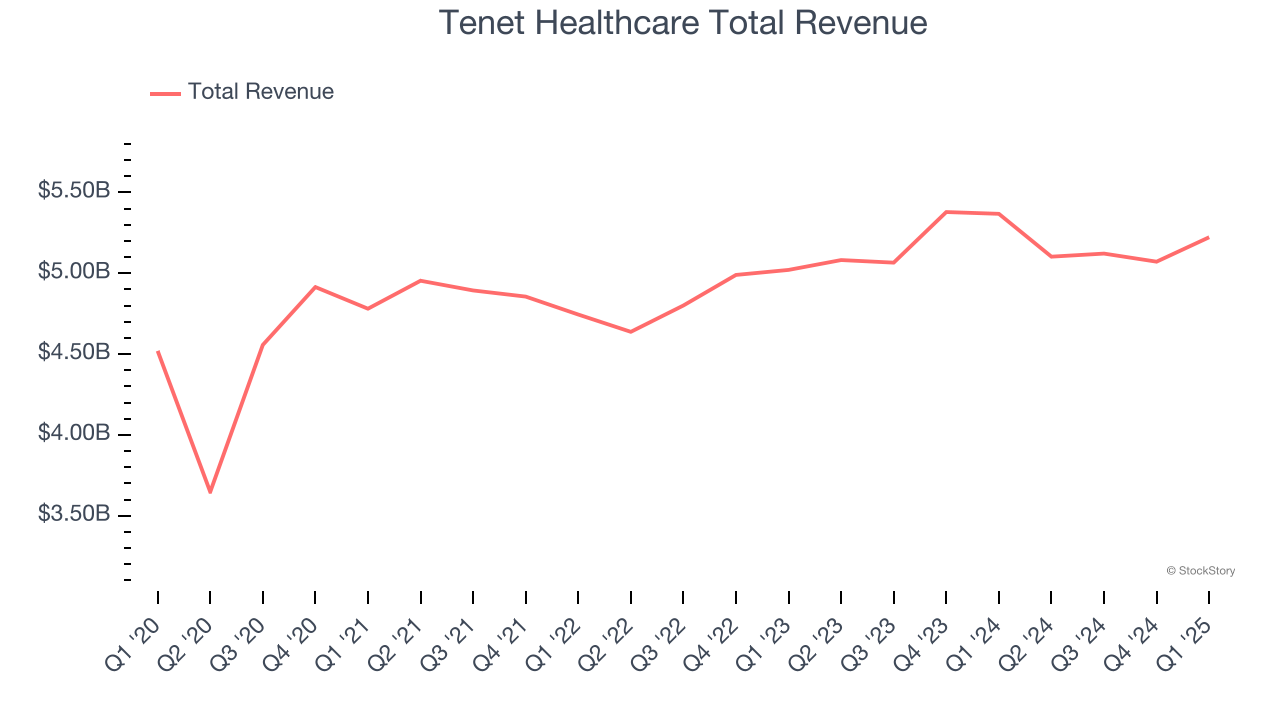

Tenet Healthcare reported revenues of $5.22 billion, down 2.7% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Tenet Healthcare pulled off the biggest analyst estimates beat but had the slowest revenue growth of the whole group. Unsurprisingly, the stock is up 36.3% since reporting and currently trades at $168.66.

Is now the time to buy Tenet Healthcare? Access our full analysis of the earnings results here, it’s free.

Acadia Healthcare (NASDAQ:ACHC)

With a network of over 250 facilities serving patients in 38 states and Puerto Rico, Acadia Healthcare (NASDAQ:ACHC) operates facilities providing mental health and substance use disorder treatment services across the United States.

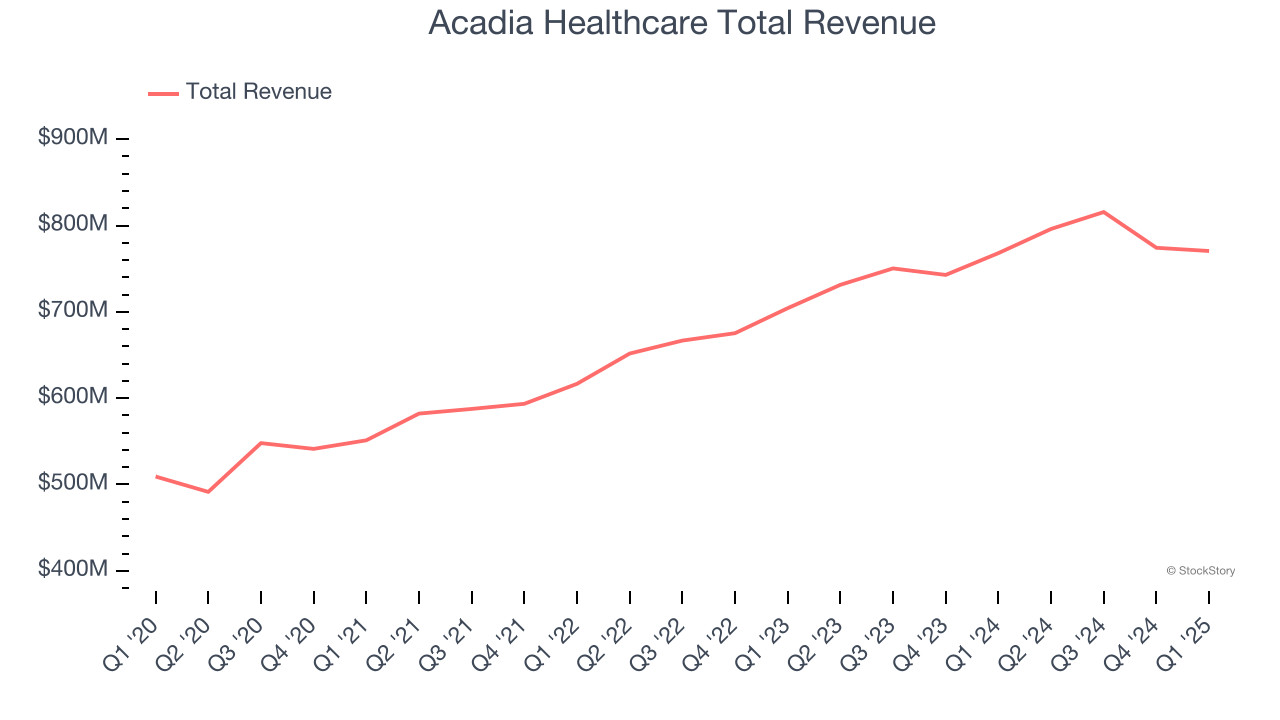

Acadia Healthcare reported revenues of $770.5 million, flat year on year, in line with analysts’ expectations. The business had a strong quarter with an impressive beat of analysts’ sales volume estimates and a solid beat of analysts’ EPS estimates.

Acadia Healthcare achieved the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.9% since reporting. It currently trades at $25.10.

Is now the time to buy Acadia Healthcare? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Universal Health Services (NYSE:UHS)

With a network spanning 39 states and three countries, Universal Health Services (NYSE:UHS) operates acute care hospitals and behavioral health facilities across the United States, United Kingdom, and Puerto Rico.

Universal Health Services reported revenues of $4.1 billion, up 6.7% year on year, falling short of analysts’ expectations by 1%. It was a mixed quarter as it posted a solid beat of analysts’ EPS estimates but same-store sales in line with analysts’ estimates.

Universal Health Services delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 13% since the results and currently trades at $195.73.

Read our full analysis of Universal Health Services’s results here.

HCA Healthcare (NYSE:HCA)

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE:HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

HCA Healthcare reported revenues of $18.32 billion, up 5.7% year on year. This print beat analysts’ expectations by 0.5%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ EPS estimates but a slight miss of analysts’ same-store sales estimates.

HCA Healthcare had the weakest full-year guidance update among its peers. The stock is up 13.1% since reporting and currently trades at $386.05.

Read our full, actionable report on HCA Healthcare here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.