As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the construction and maintenance services industry, including Construction Partners (NASDAQ:ROAD) and its peers.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 13 construction and maintenance services stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.1% since the latest earnings results.

Best Q4: Construction Partners (NASDAQ:ROAD)

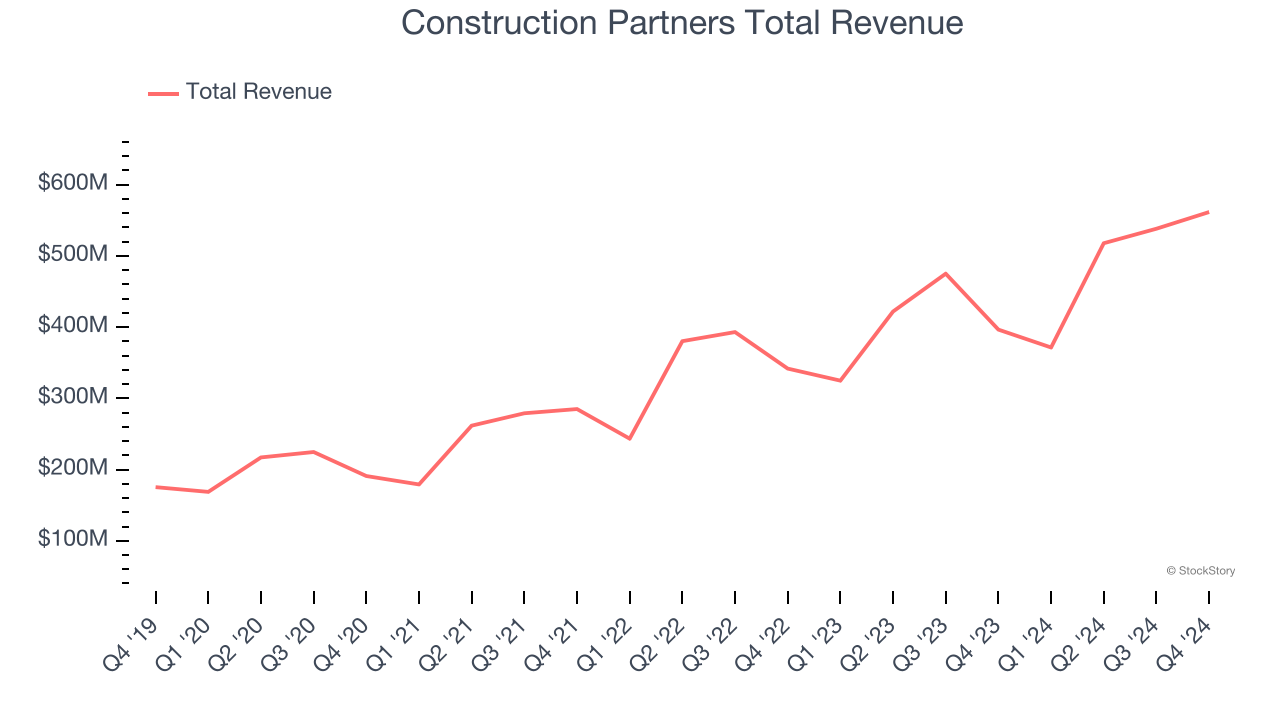

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Construction Partners reported revenues of $561.6 million, up 41.6% year on year. This print exceeded analysts’ expectations by 9.7%. Overall, it was an incredible quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "Today we are reporting strong first quarter performance, with revenue growth of 42% and Adjusted EBITDA growth of 68% compared to the first quarter last year, which led to an exceptional first quarter Adjusted EBITDA margin of 12.25%. The outstanding operational performance of our family of companies throughout the Sunbelt and favorable weather during the quarter produced these strong results. We also continued to win more project work, growing our project backlog to a record $2.66 billion. We were pleased to have completed the transformational acquisition of Lone Star Paving, our new platform company in Texas, during the first quarter. In addition, we have completed two acquisitions since January 2025. In January, we entered Oklahoma by acquiring our eighth platform company, Overland Corporation, which is well-positioned to participate in the strong economic activity occurring in southern Oklahoma and northern Texas. Earlier this week, we announced our latest strategic acquisition with the purchase of Mobile Asphalt Company in Mobile, Alabama. This represents a significant expansion of our presence in the Mobile metro area and the surrounding southwestern Alabama markets following our initial entry into Mobile last September. Reflecting these strong first quarter results and incorporating the expected contribution of these two newly acquired companies, we are raising our fiscal 2025 outlook ranges."

Construction Partners achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 17.6% since reporting and currently trades at $69.84.

Comfort Systems (NYSE:FIX)

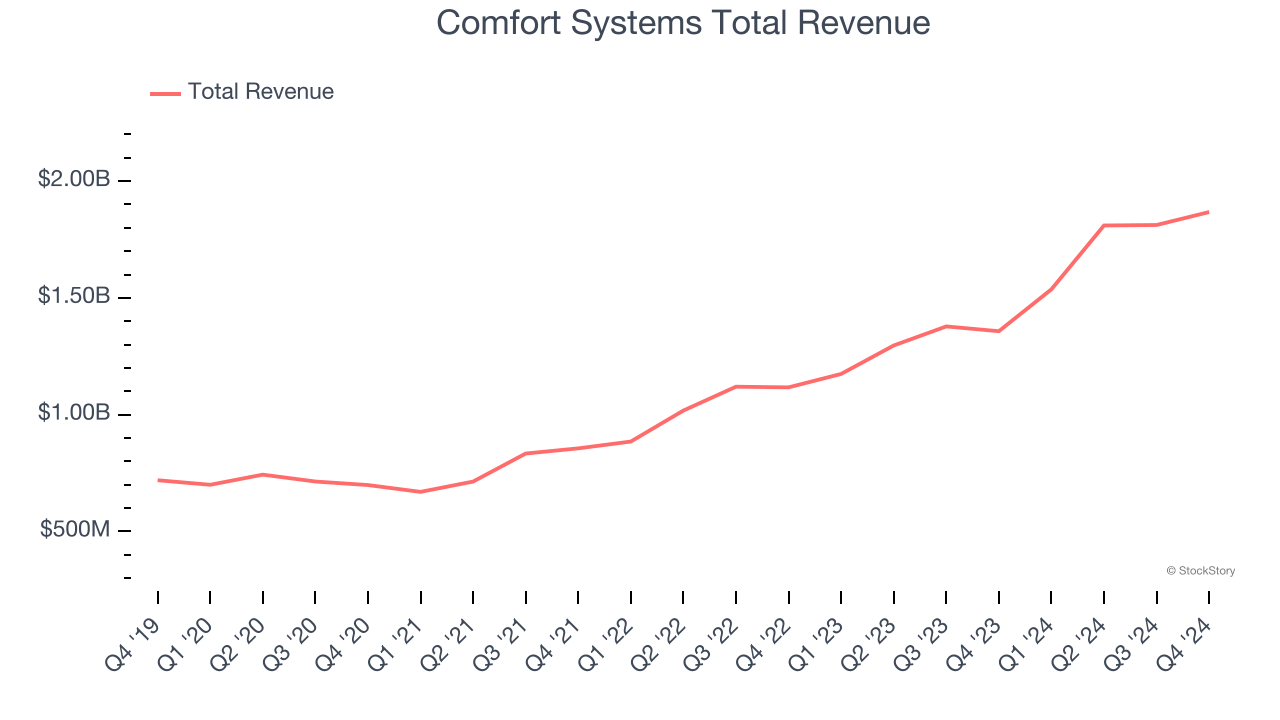

Formed through the merger of 12 companies, Comfort Systems (NYSE:FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $1.87 billion, up 37.6% year on year, outperforming analysts’ expectations by 5.5%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

The stock is down 18.1% since reporting. It currently trades at $312.98.

Is now the time to buy Comfort Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Concrete Pumping (NASDAQ:BBCP)

Going public via SPAC in 2018, Concrete Pumping (NASDAQ:BBCP) is a provider of concrete pumping and waste management services in the United States and the United Kingdom.

Concrete Pumping reported revenues of $86.45 million, down 11.5% year on year, falling short of analysts’ expectations by 4.8%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 12.1% since the results and currently trades at $5.32.

Read our full analysis of Concrete Pumping’s results here.

Orion (NYSE:ORN)

Established in 1994, Orion (NYSE:ORN) provides construction services for marine infrastructure and industrial projects.

Orion reported revenues of $216.9 million, up 7.6% year on year. This number missed analysts’ expectations by 20.2%. It was a softer quarter as it also logged full-year EBITDA guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

Orion had the weakest performance against analyst estimates among its peers. The stock is down 10.5% since reporting and currently trades at $5.79.

Read our full, actionable report on Orion here, it’s free.

APi (NYSE:APG)

Started in 1926 as an insulation contractor, APi (NYSE:APG) provides life safety solutions and specialty services for buildings and infrastructure.

APi reported revenues of $1.86 billion, up 5.8% year on year. This result topped analysts’ expectations by 1.2%. Zooming out, it was a mixed quarter as it also recorded a narrow beat of analysts’ organic revenue estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is down 18.2% since reporting and currently trades at $32.81.

Read our full, actionable report on APi here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.