As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the gas and liquid handling industry, including Gorman-Rupp (NYSE:GRC) and its peers.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 19.2% since the latest earnings results.

Gorman-Rupp (NYSE:GRC)

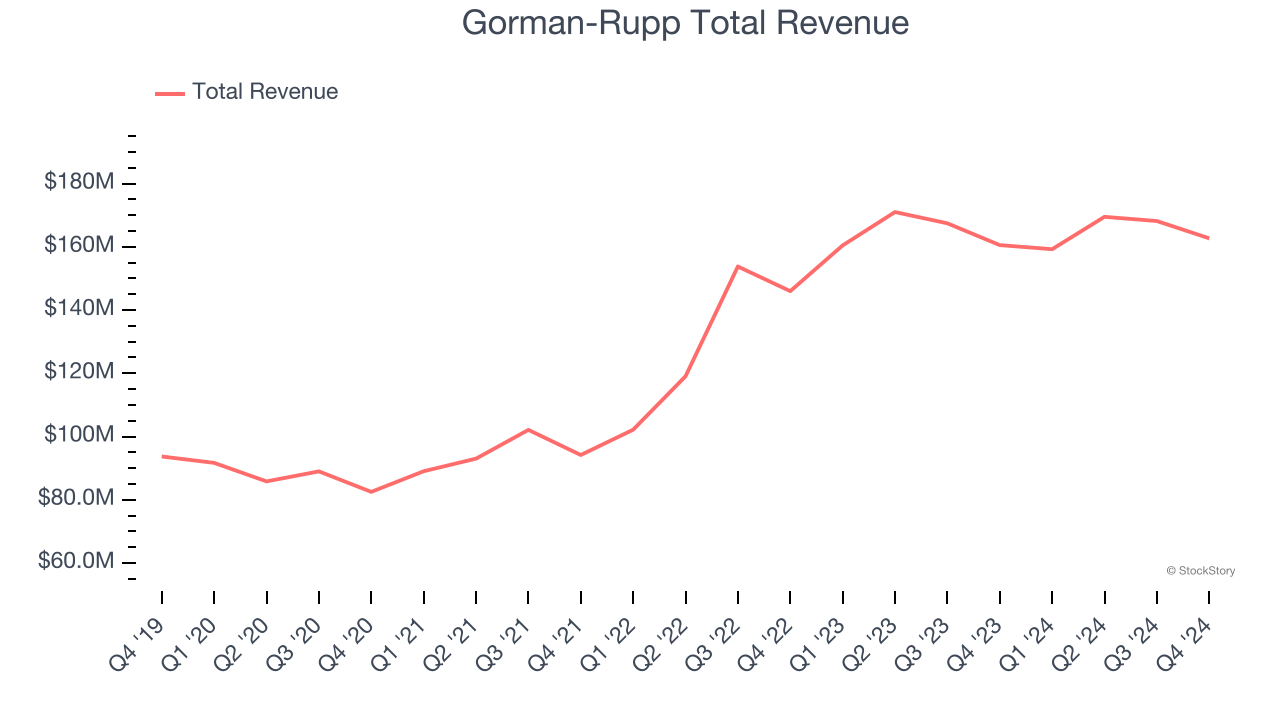

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE:GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

Gorman-Rupp reported revenues of $162.7 million, up 1.3% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and EBITDA in line with analysts’ estimates.

Scott A. King, President and CEO, commented, “We are pleased that we achieved an improvement in gross margin and operating income in 2024, as well as a 28% increase in adjusted earnings per share for the year. We also reduced our debt by $43 million, which along with our refinancing in the second quarter of 2024, resulted in a significant reduction in interest expense and positions us well to further reduce our debt and interest expense going forward. In addition to our strong operating results, we were proud to increase our dividend for the 52nd consecutive year, and in January of 2025 we declared our 300th consecutive quarterly dividend, marking 75 years of continued dividends. As we begin 2025 our outlook remains positive. While sales were less than expected in 2024, we continued to see strong incoming orders during the year and ended the year with healthy backlog to begin the new year. As demonstrated by our increase in municipal sales in 2024, we remain well positioned to continue to benefit from infrastructure spending and the strong demand for flood control and storm water management. We remain focused on delivering long-term profitable growth.

The stock is down 12.3% since reporting and currently trades at $33.17.

Is now the time to buy Gorman-Rupp? Access our full analysis of the earnings results here, it’s free.

Best Q4: SPX Technologies (NYSE:SPXC)

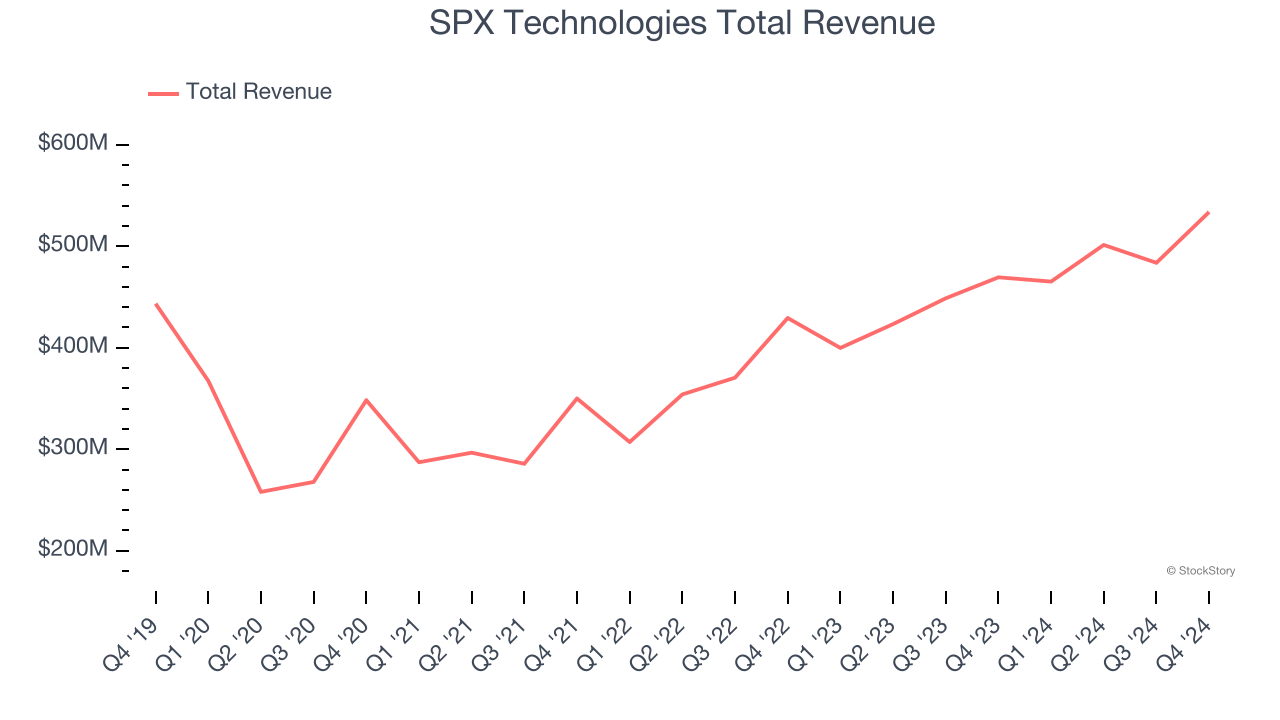

SPX Technologies (NYSE:SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $533.7 million, up 13.7% year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

SPX Technologies delivered the fastest revenue growth among its peers. The stock is down 8% since reporting. It currently trades at $125.46.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Graco (NYSE:GGG)

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $548.7 million, down 3.2% year on year, falling short of analysts’ expectations by 1.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 11.3% since the results and currently trades at $76.29.

Read our full analysis of Graco’s results here.

Chart (NYSE:GTLS)

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE:GTLS) provides equipment to store and transport gasses.

Chart reported revenues of $1.11 billion, up 9% year on year. This number lagged analysts' expectations by 4.5%. Zooming out, it was a satisfactory quarter as it also logged an impressive beat of analysts’ backlog estimates.

Chart achieved the highest full-year guidance raise but had the weakest performance against analyst estimates among its peers. The stock is down 29.2% since reporting and currently trades at $129.06.

Read our full, actionable report on Chart here, it’s free.

IDEX (NYSE:IEX)

Founded in 1988, IDEX (NYSE:IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

IDEX reported revenues of $862.9 million, up 9.4% year on year. This print came in 0.6% below analysts' expectations. Overall, it was a slower quarter as it also recorded EPS guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ EBITDA estimates.

The stock is down 23.2% since reporting and currently trades at $167.70.

Read our full, actionable report on IDEX here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.