Diversified solutions provider Matthews International (NASDAQ:MATW) announced better-than-expected revenue in Q3 CY2025, but sales fell by 28.6% year on year to $318.8 million. Its GAAP loss of $0.88 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Matthews? Find out by accessing our full research report, it’s free for active Edge members.

Matthews (MATW) Q3 CY2025 Highlights:

- Revenue: $318.8 million vs analyst estimates of $290.8 million (28.6% year-on-year decline, 9.6% beat)

- EPS (GAAP): -$0.88 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $51.52 million vs analyst estimates of $42.2 million (16.2% margin, 22.1% beat)

- EBITDA guidance for the upcoming financial year 2026 is $180 million at the midpoint, below analyst estimates of $186.4 million

- Operating Margin: -3.6%, down from 12.7% in the same quarter last year

- Free Cash Flow Margin: 0.3%, down from 5.4% in the same quarter last year

- Market Capitalization: $764.8 million

Company Overview

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Revenue Growth

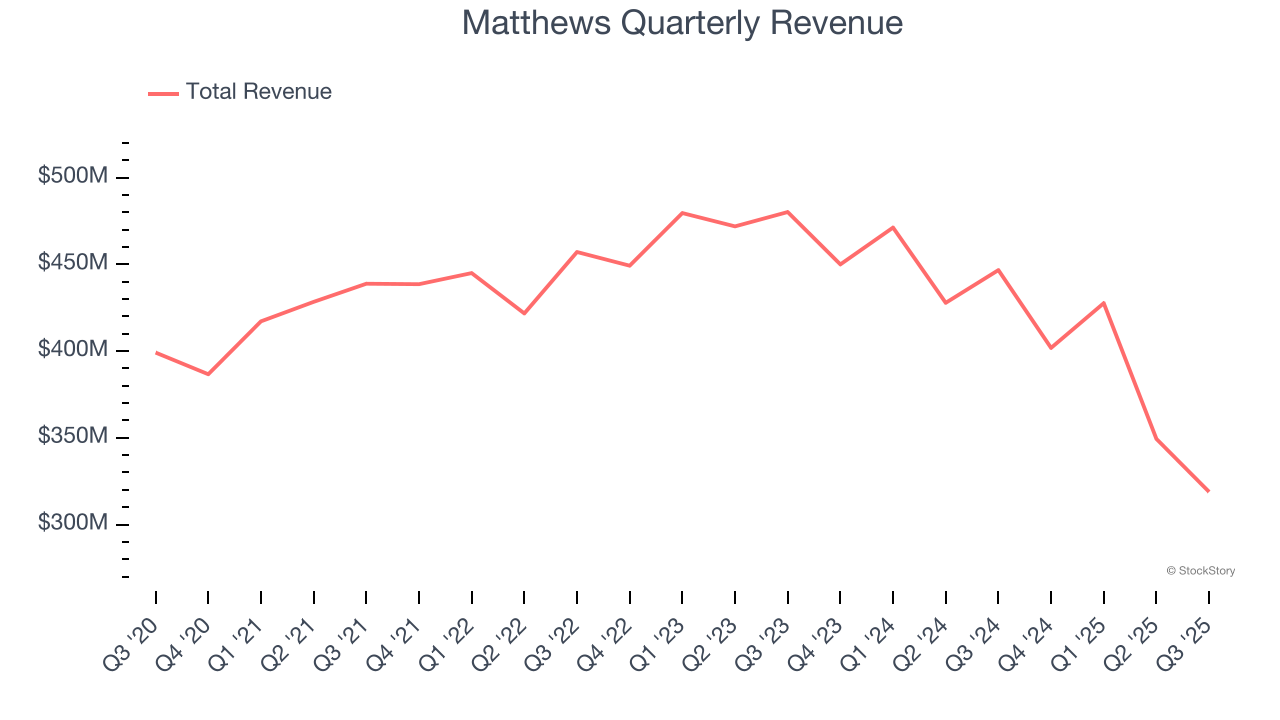

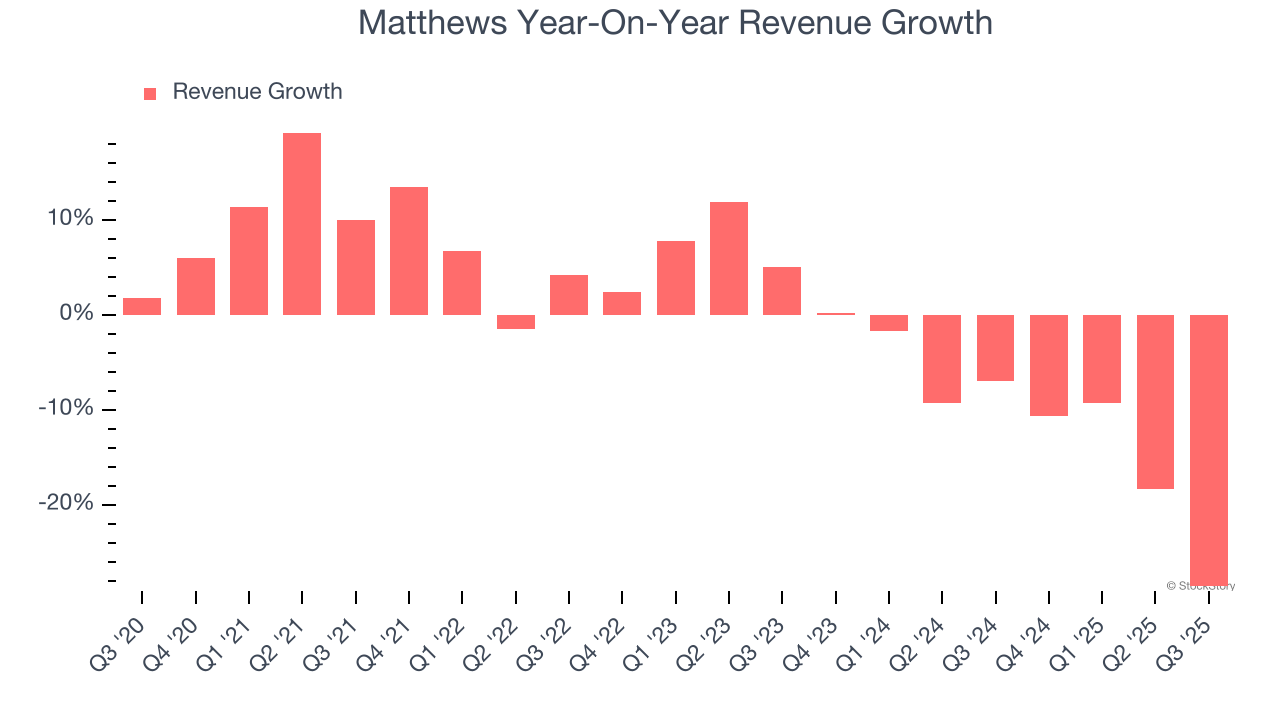

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Matthews struggled to consistently increase demand as its $1.50 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Matthews’s recent performance shows its demand remained suppressed as its revenue has declined by 10.8% annually over the last two years.

This quarter, Matthews’s revenue fell by 28.6% year on year to $318.8 million but beat Wall Street’s estimates by 9.6%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

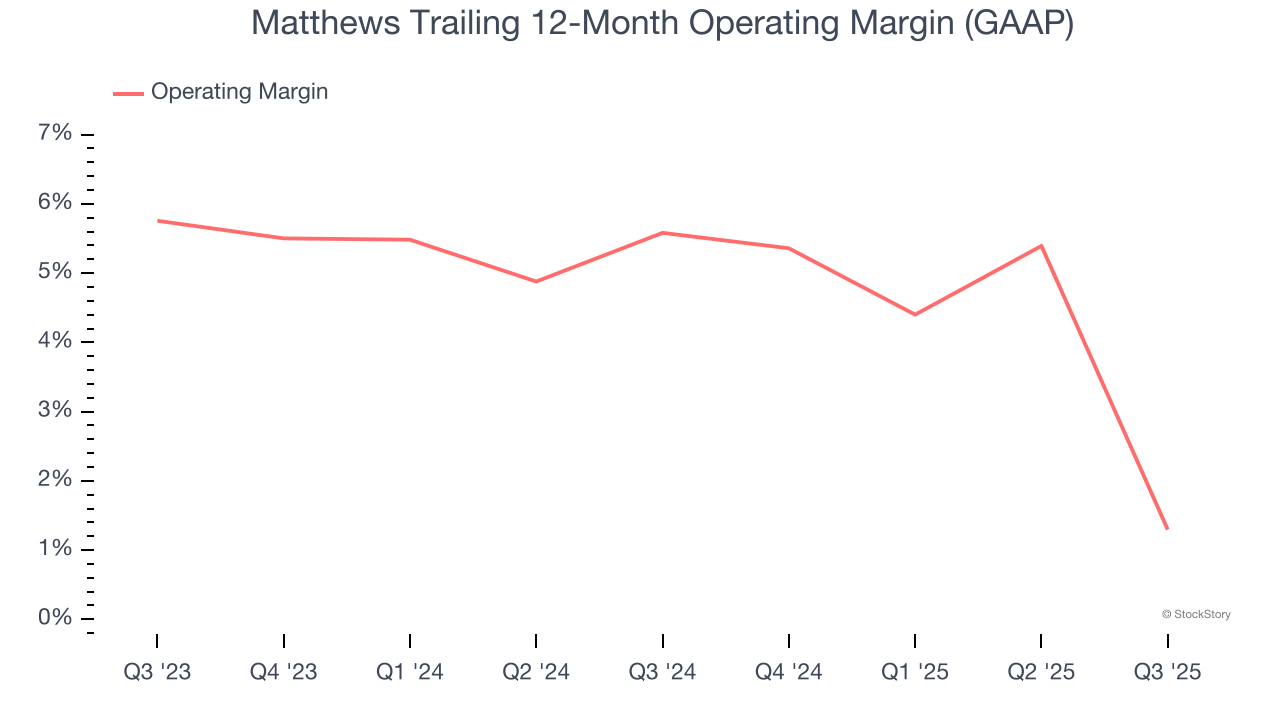

Matthews’s operating margin has shrunk over the last 12 months and averaged 3.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Matthews generated an operating margin profit margin of negative 3.6%, down 16.3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

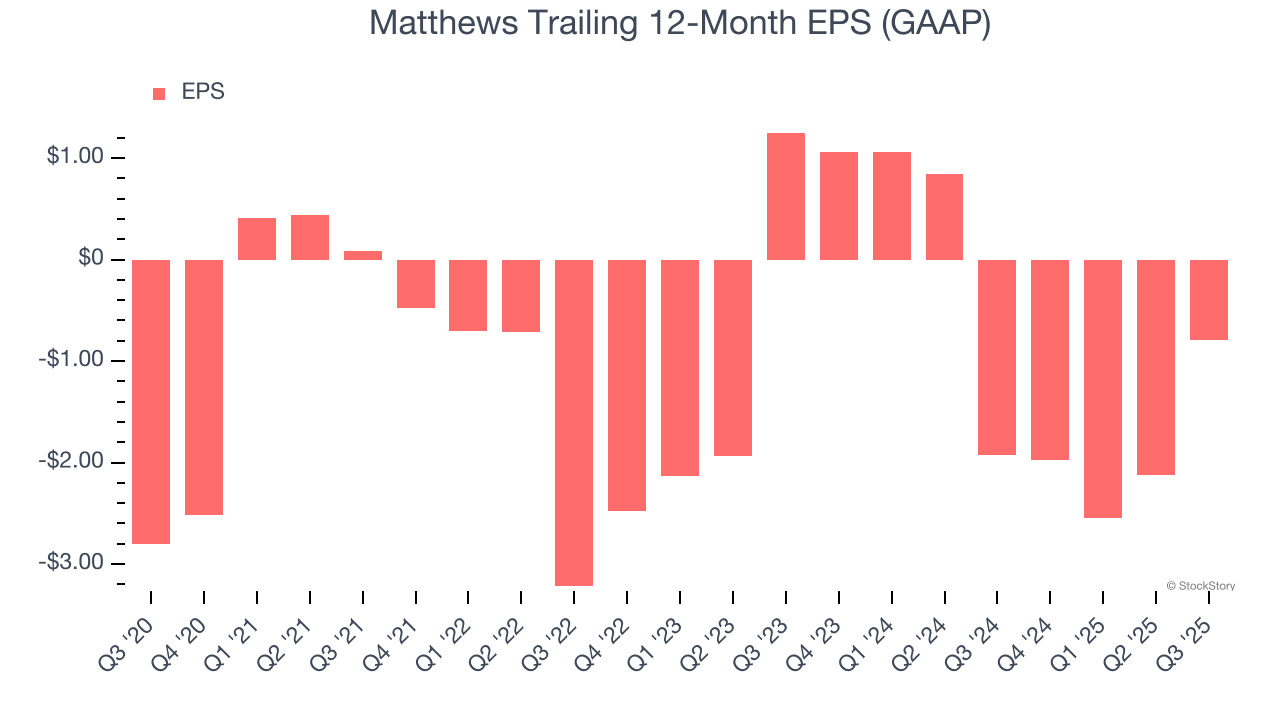

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Matthews’s full-year earnings are still negative, it reduced its losses and improved its EPS by 22.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, Matthews reported EPS of negative $0.88, up from negative $2.21 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Matthews’s Q3 Results

We were impressed by how significantly Matthews blew past analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $24.63 immediately following the results.

Big picture, is Matthews a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.