Clothing and accessories retailer Gap (NYSE:GAP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 3% year on year to $3.94 billion. Its GAAP profit of $0.62 per share was 5.6% above analysts’ consensus estimates.

Is now the time to buy Gap? Find out by accessing our full research report, it’s free for active Edge members.

Gap (GAP) Q3 CY2025 Highlights:

- Revenue: $3.94 billion vs analyst estimates of $3.91 billion (3% year-on-year growth, 0.8% beat)

- EPS (GAAP): $0.62 vs analyst estimates of $0.59 (5.6% beat)

- Adjusted EBITDA: $459 million vs analyst estimates of $398.8 million (11.6% margin, 15.1% beat)

- Operating Margin: 8.5%, in line with the same quarter last year

- Free Cash Flow Margin: 3.9%, similar to the same quarter last year

- Same-Store Sales rose 5% year on year (1% in the same quarter last year)

- Market Capitalization: $8.71 billion

"We are proud to report that Gap Inc.'s third quarter results exceeded our net sales and margin expectations and delivered the seventh consecutive quarter of positive comparable sales," said President and Chief Executive Officer, Richard Dickson.

Company Overview

Operating under the Gap, Old Navy, Banana Republic, and Athleta brands, Gap (NYSE:GAP) is an apparel and accessories retailer selling casual clothing to men, women, and children.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $15.28 billion in revenue over the past 12 months, Gap is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Gap likely needs to optimize its pricing or lean into international expansion.

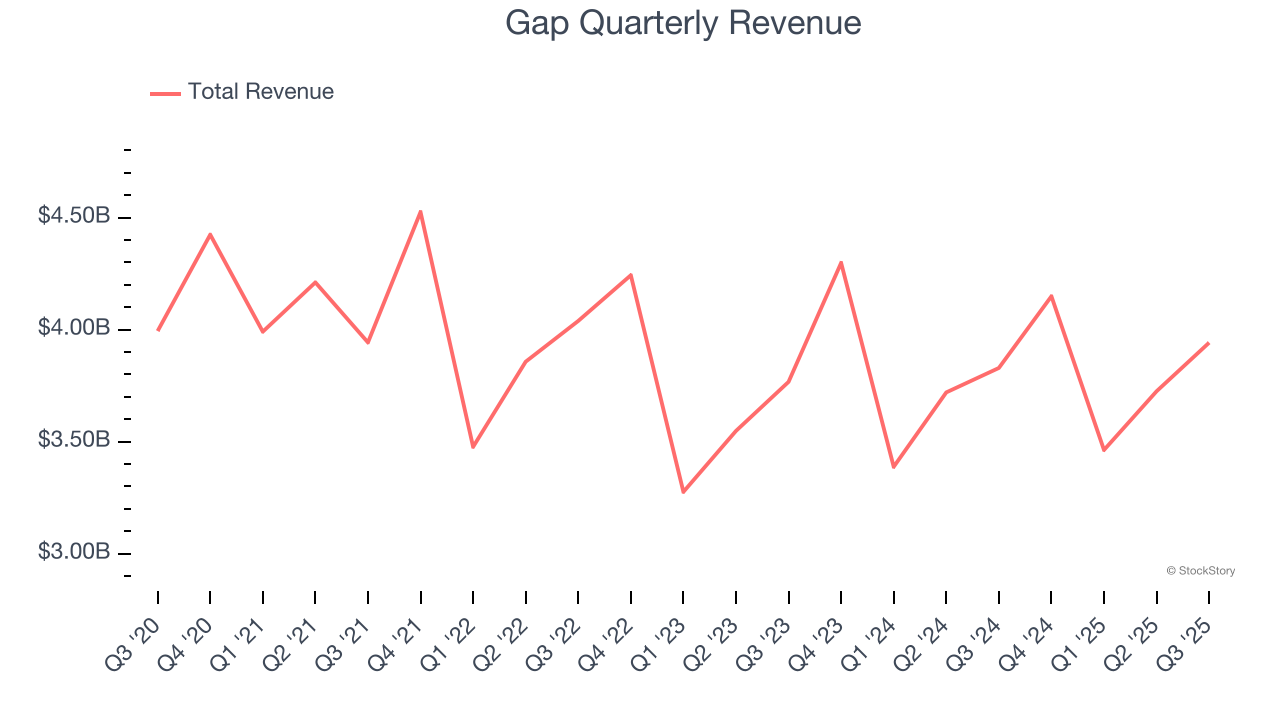

As you can see below, Gap’s revenue declined by 1.1% per year over the last six years (we compare to 2019 to normalize for COVID-19 impacts) despite opening new stores and expanding its reach.

This quarter, Gap reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months. Although this projection suggests its newer products will catalyze better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

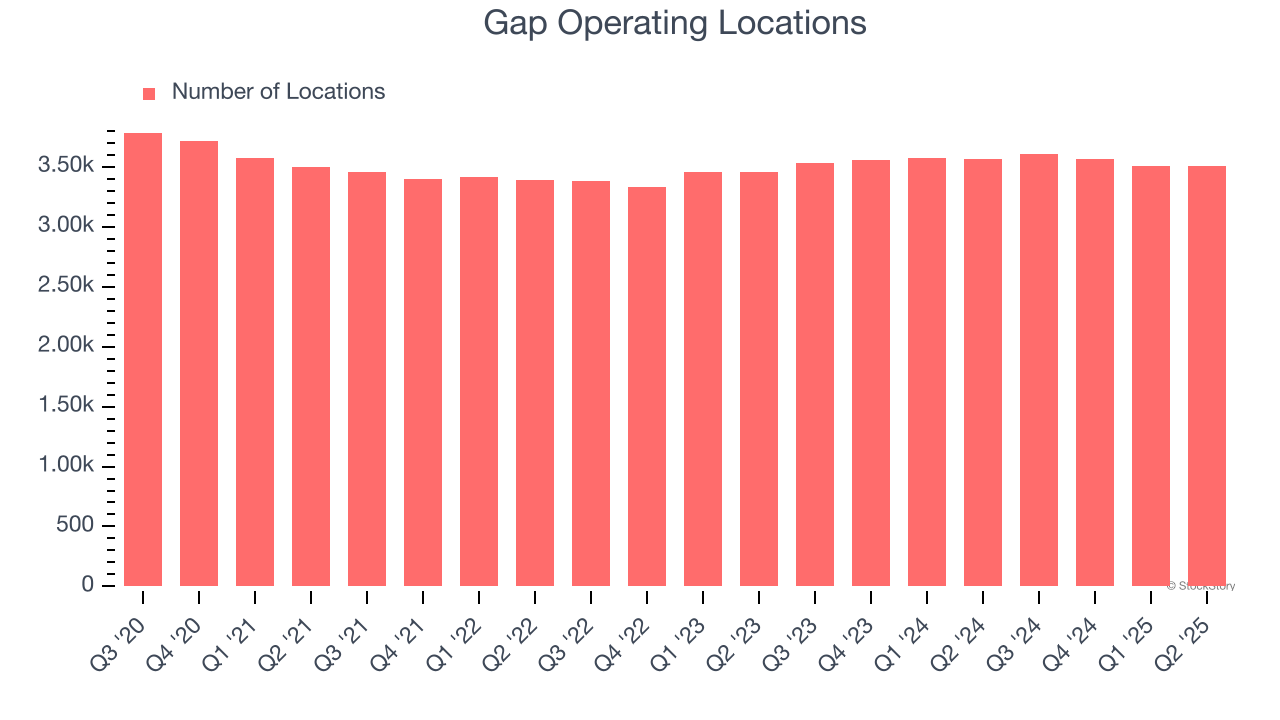

A retailer’s store count often determines how much revenue it can generate.

Over the last two years, Gap opened new stores quickly, averaging 1.8% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Gap reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

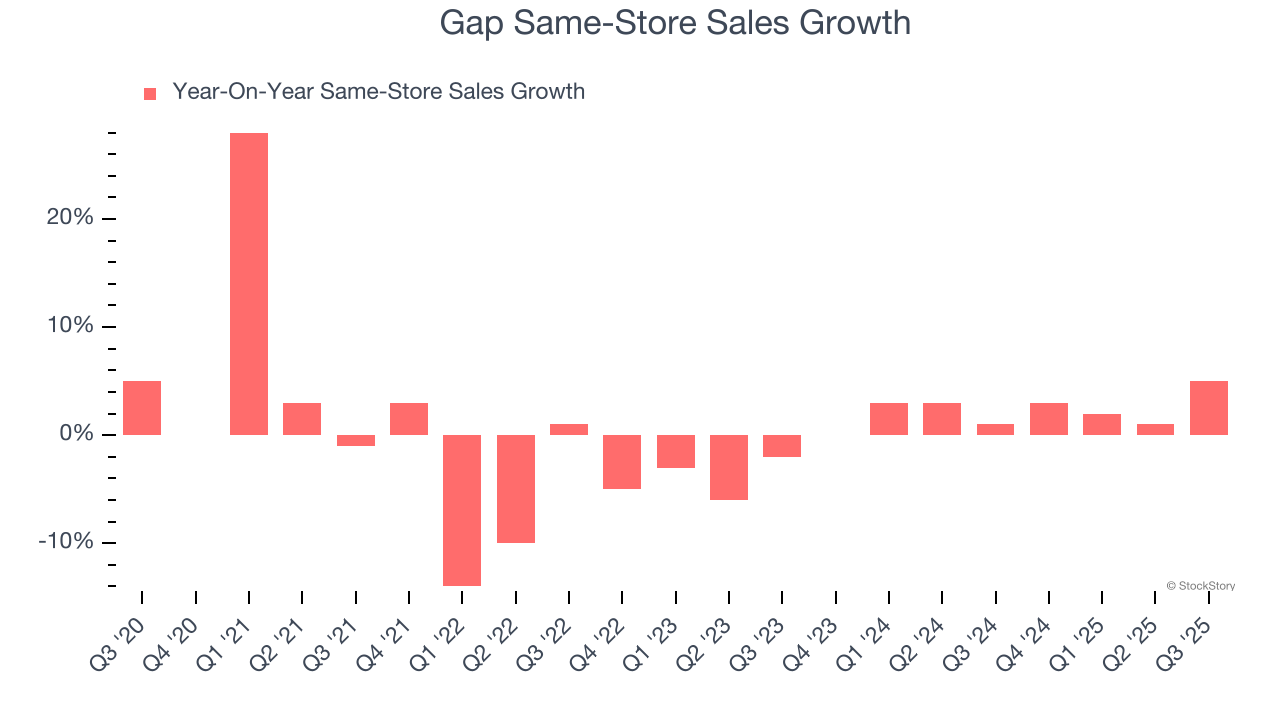

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Gap’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.3% per year. This performance suggests its rollout of new stores could be beneficial for shareholders. When a retailer has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Gap’s same-store sales rose 5% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Gap’s Q3 Results

We were impressed by how significantly Gap blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.8% to $24.15 immediately following the results.

Gap had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.