As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at semiconductor manufacturing stocks, starting with Kulicke and Soffa (NASDAQ:KLIC).

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was in line.

Luckily, semiconductor manufacturing stocks have performed well with share prices up 32.4% on average since the latest earnings results.

Kulicke and Soffa (NASDAQ:KLIC)

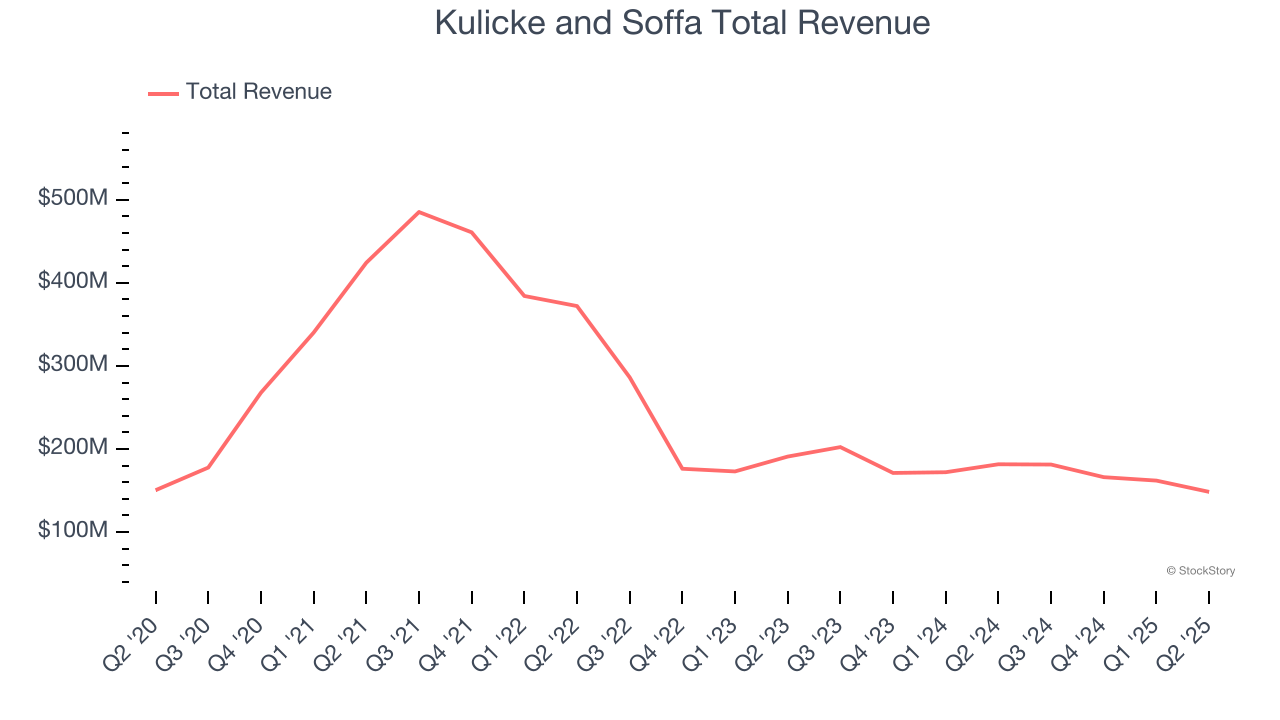

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $148.4 million, down 18.3% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and adjusted operating income estimates.

Fusen Chen, Kulicke & Soffa's President and Chief Executive Officer, stated, "We continue to execute on multiple technology transitions supported by parallel customer engagements. As we expand our portfolio, we are unlocking new opportunities across general semiconductor, memory, automotive, and industrial markets. Additionally, we are encouraged by positive market feedback of our latest solutions and also by recent order momentum within our highest-volume regions."

Interestingly, the stock is up 26.9% since reporting and currently trades at $40.70.

Is now the time to buy Kulicke and Soffa? Access our full analysis of the earnings results here, it’s free for active Edge members.

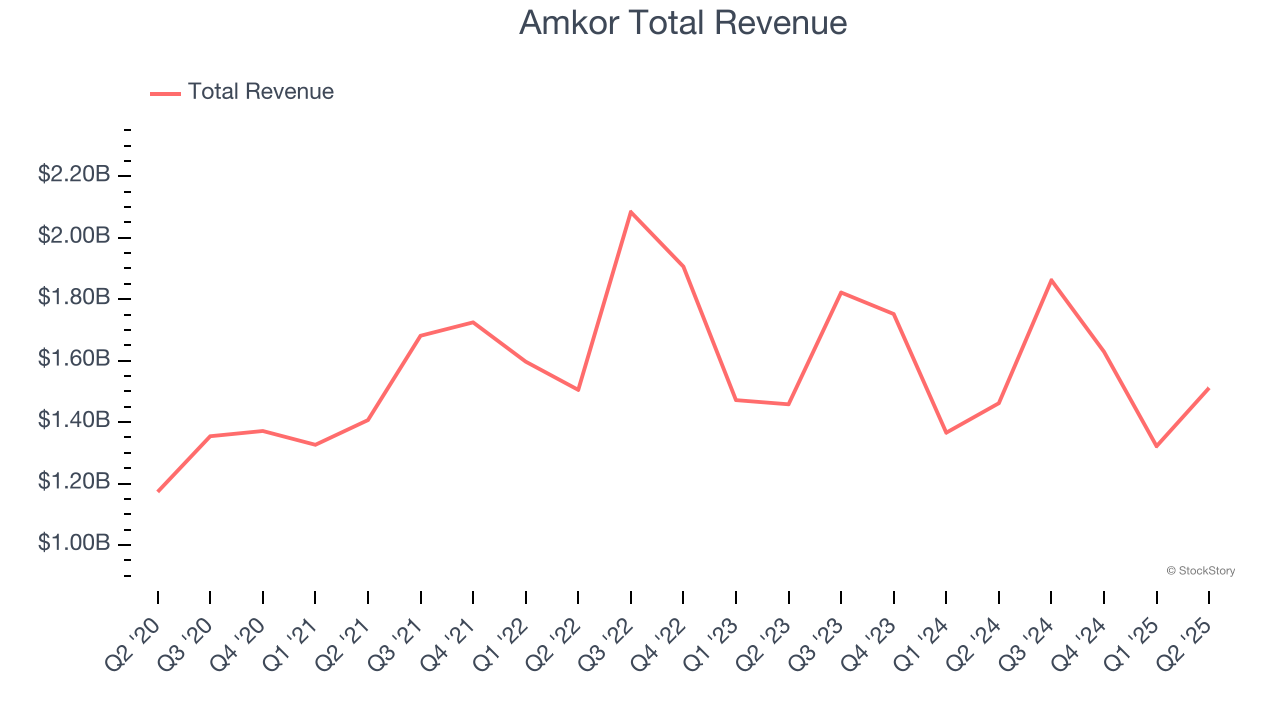

Best Q2: Amkor (NASDAQ:AMKR)

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.51 billion, up 3.4% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 46.9% since reporting. It currently trades at $31.20.

Is now the time to buy Amkor? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $2.01 billion, up 57.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and revenue in line with analysts’ estimates.

Marvell Technology delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 20.3% since the results and currently trades at $93.

Read our full analysis of Marvell Technology’s results here.

Teradyne (NASDAQ:TER)

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ:TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

Teradyne reported revenues of $651.8 million, down 10.7% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The stock is up 59.7% since reporting and currently trades at $144.69.

Read our full, actionable report on Teradyne here, it’s free for active Edge members.

Lam Research (NASDAQ:LRCX)

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research (NASDAQ:LRCX) is one of the leading providers of wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $5.17 billion, up 33.6% year on year. This result beat analysts’ expectations by 3.3%. Overall, it was a stunning quarter as it also put up a significant improvement in its inventory levels and a beat of analysts’ EPS estimates.

The stock is up 45% since reporting and currently trades at $143.75.

Read our full, actionable report on Lam Research here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.