As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the traditional media & publishing industry, including Sinclair (NASDAQ:SBGI) and its peers.

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

The 4 traditional media & publishing stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

Luckily, traditional media & publishing stocks have performed well with share prices up 32.7% on average since the latest earnings results.

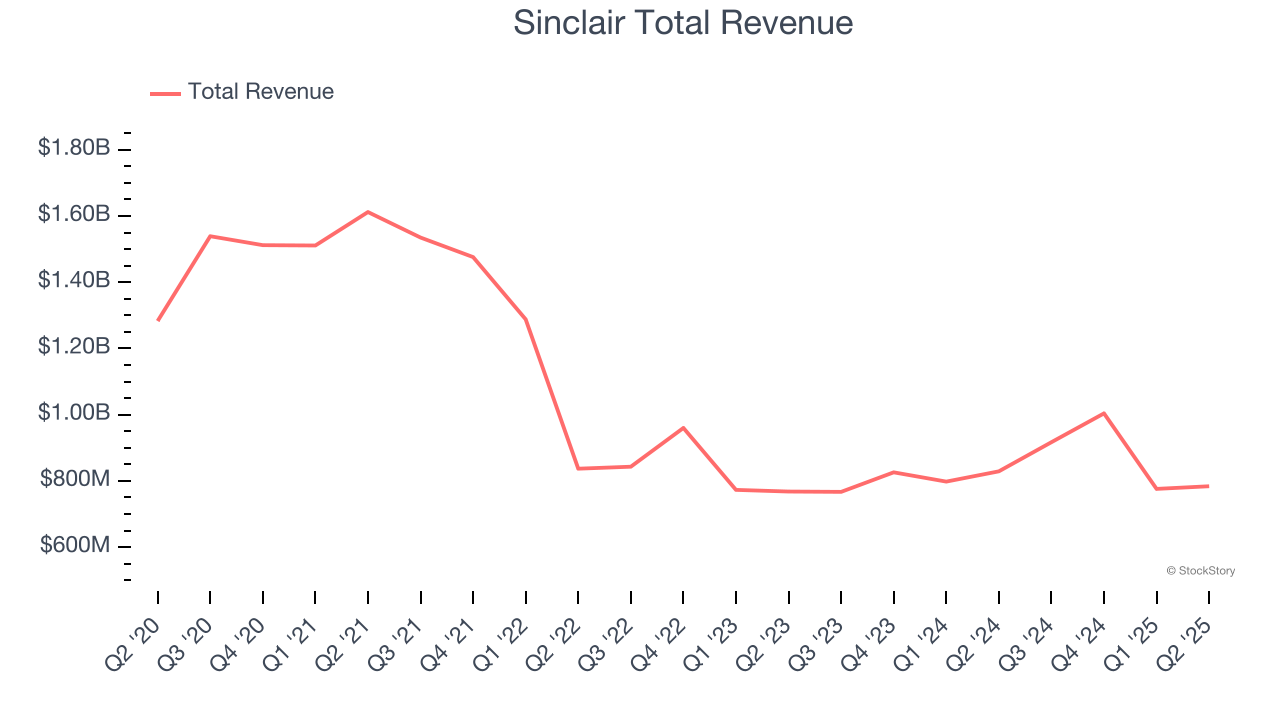

Sinclair (NASDAQ:SBGI)

With over 2,400 hours of local news produced weekly and 640 broadcast channels reaching millions of American homes, Sinclair (NASDAQ:SBGI) operates a network of 185 local television stations across 86 U.S. markets, producing news programming and distributing content from major networks.

Sinclair reported revenues of $784 million, down 5.4% year on year. This print fell short of analysts’ expectations by 2.2%. Overall, it was a slower quarter for the company with revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ revenue estimates.

Unsurprisingly, the stock is down 4.6% since reporting and currently trades at $13.50.

Read our full report on Sinclair here, it’s free for active Edge members.

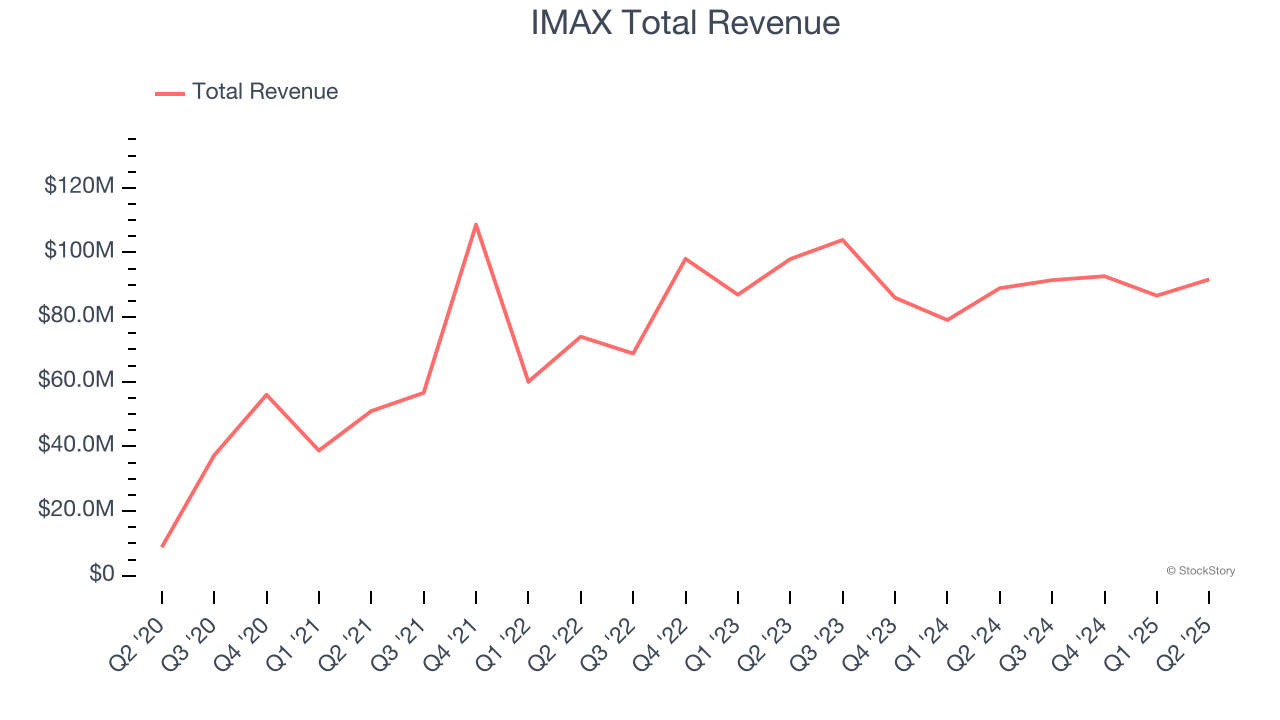

Best Q2: IMAX (NYSE:IMAX)

Originally developed for World Expo '67 in Montreal as an innovative projection system, IMAX (NYSE:IMAX) provides proprietary large-format cinema technology and systems that deliver immersive movie experiences with enhanced image quality and sound.

IMAX reported revenues of $91.68 million, up 3.1% year on year, outperforming analysts’ expectations by 1%. The business had an exceptional quarter with a beat of analysts’ EPS and revenue estimates.

IMAX pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.7% since reporting. It currently trades at $31.87.

Is now the time to buy IMAX? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: EchoStar (NASDAQ:SATS)

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ:SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

EchoStar reported revenues of $3.72 billion, down 5.8% year on year, falling short of analysts’ expectations by 2.2%. It was a softer quarter as it posted a significant miss of analysts’ revenue and EPS estimates.

EchoStar delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 135% since the results and currently trades at $76.50.

Read our full analysis of EchoStar’s results here.

Wiley (NYSE:WLY)

With roots dating back to 1807 when Charles Wiley opened a small printing shop in Manhattan, John Wiley & Sons (NYSE:WLY) is a global academic publisher that provides scientific journals, books, digital courseware, and knowledge solutions for researchers, students, and professionals.

Wiley reported revenues of $396.8 million, down 1.7% year on year. This number surpassed analysts’ expectations by 5.8%. Zooming out, it was a mixed quarter as it also produced a solid beat of analysts’ revenue estimates but full-year revenue guidance missing analysts’ expectations.

Wiley delivered the biggest analyst estimates beat among its peers. The stock is down 9% since reporting and currently trades at $36.20.

Read our full, actionable report on Wiley here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.