Since June 2024, Hormel Foods has been in a holding pattern, posting a small return of 4% while floating around $31.42. The stock also fell short of the S&P 500’s 9.7% gain during that period.

Is there a buying opportunity in Hormel Foods, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We're swiping left on Hormel Foods for now. Here are three reasons why there are better opportunities than HRL and a stock we'd rather own.

Why Is Hormel Foods Not Exciting?

Best known for its SPAM brand, Hormel (NYSE:HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

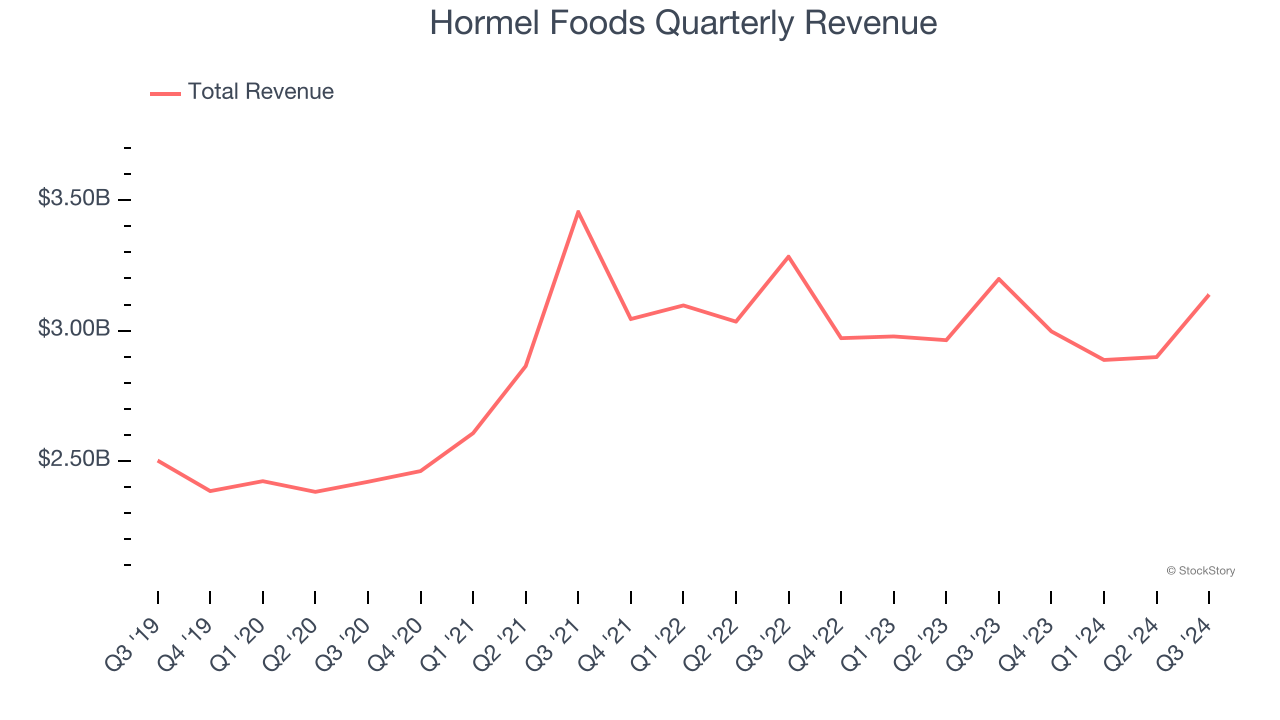

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Hormel Foods’s sales grew at a sluggish 1.5% compounded annual growth rate over the last three years. This fell short of our benchmarks.

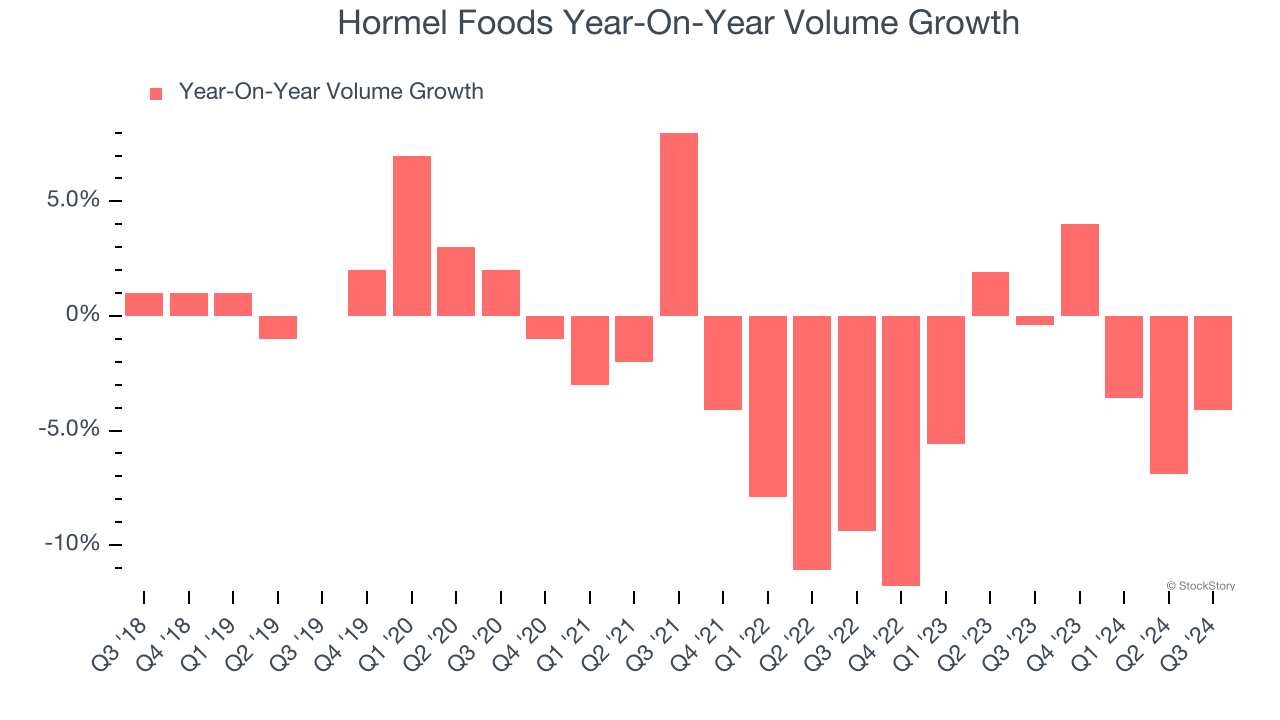

2. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Hormel Foods’s average quarterly sales volumes have shrunk by 3.3% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

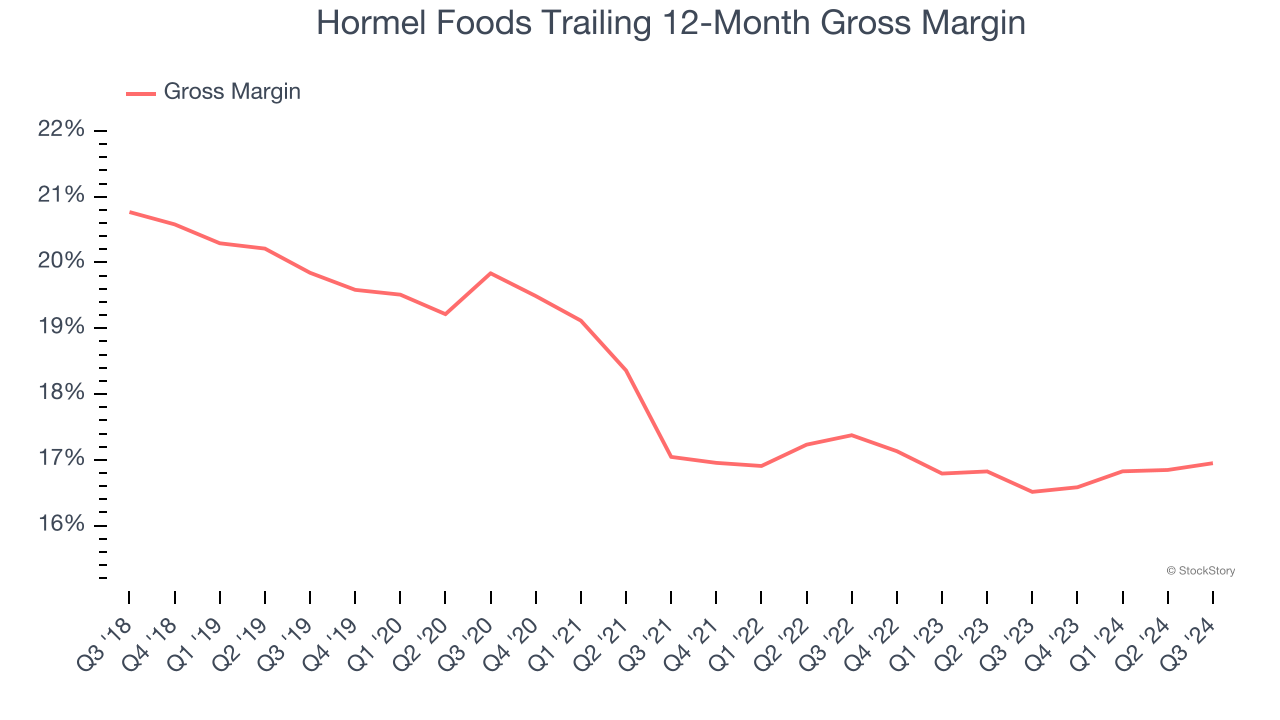

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Hormel Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 16.7% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $83.27 went towards paying for raw materials, production of goods, transportation, and distribution.

Final Judgment

Hormel Foods’s business quality ultimately falls short of our standards. With its shares trailing the market in recent months, the stock trades at 19× forward price-to-earnings (or $31.42 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Hormel Foods

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.