Over the past six months, Walmart has been a great trade, beating the S&P 500 by 25.8%. Its stock price has climbed to $92.72, representing a healthy 35.8% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Walmart, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we're swiping left on Walmart for now. Here are three reasons why there are better opportunities than WMT and a stock we'd rather own.

Why Is Walmart Not Exciting?

Known for its large-format Supercenters, Walmart (NYSE:WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Walmart’s 5.3% annualized revenue growth over the last five years was tepid. This was below our standard for the consumer retail sector.

2. Low Gross Margin Reveals Weak Structural Profitability

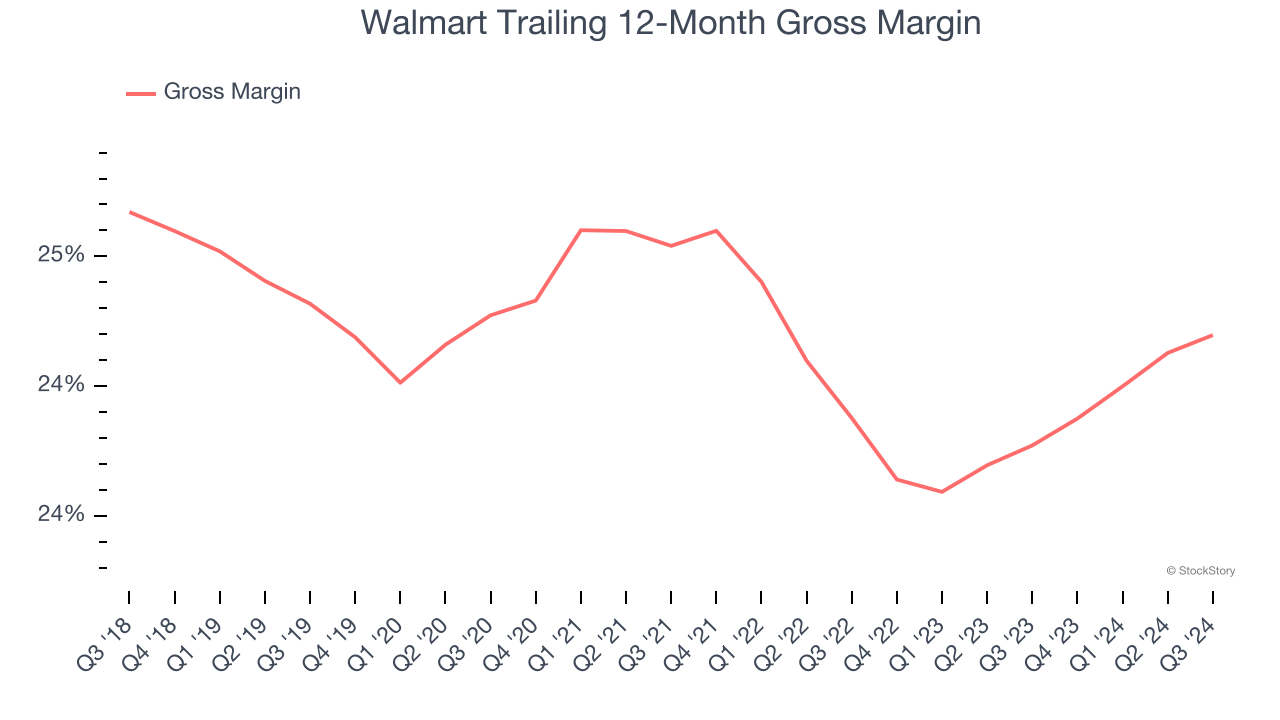

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Walmart has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 24.5% gross margin over the last two years. Said differently, Walmart had to pay a chunky $75.51 to its suppliers for every $100 in revenue.

3. Weak Operating Margin Could Cause Trouble

Operating margin is a key profitability metric because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

Walmart was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.2% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

Walmart’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 35.1× forward price-to-earnings (or $92.72 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than Walmart

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.