Palo Alto Networks (PANW) stock is well off its highs, despite producing stellar free cash flow (FCF) and FCF margins for its fiscal Q1 ending Oct. 31. That implies its price target is at least 17% higher at $212 per share.

PANW is at $185.13 on Monday morning, Nov. 24, well off its recent high of $221.38 on Oct. 28. After the company's recent results were released on Nov. 19, 2025, PANW stock could be a bargain.

Strong Revenue and FCF Growth, Along with High FCF Margins

This is because its revenue growth and FCF margins came in very strong. Its fiscal Q1 2026 revenue was up +15.67% to $2.474 billion, and its adjusted FCF rose +16.85% in the quarter to $1.713 billion.

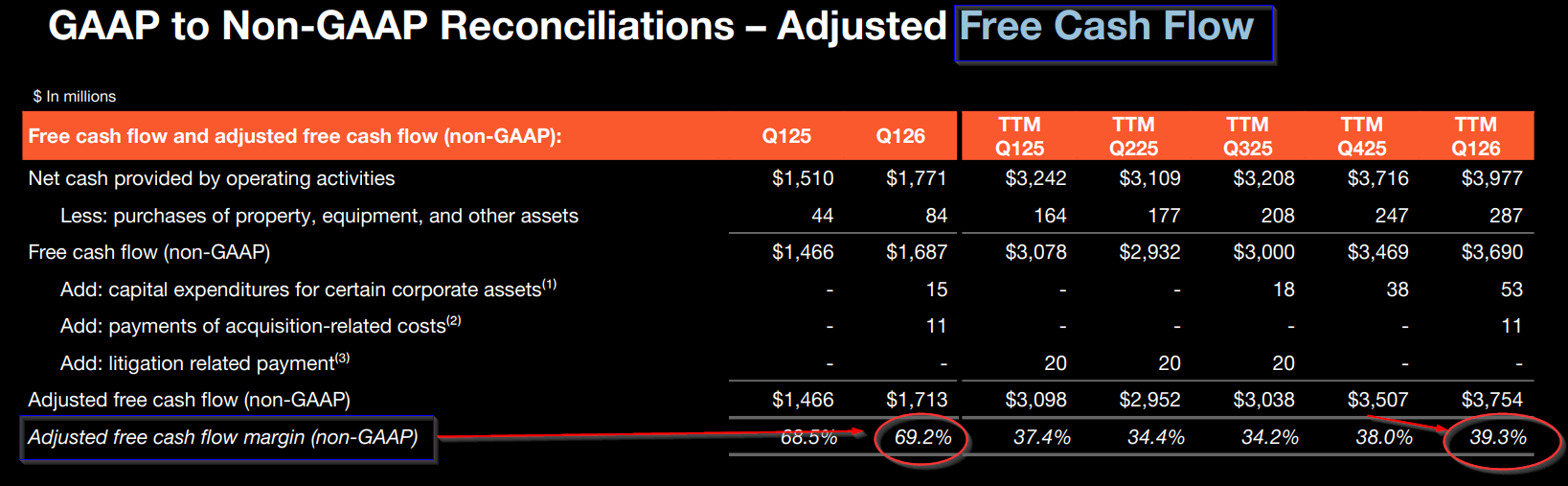

In addition, on a trailing 12-month basis (TTM), the company generated a new high adjusted FCF margin of 39.3%. This is important since its Q1 typically has a higher margin as its subscriber clients renew their annual cybercode protection subscriptions.

Therefore, it's essential to review the prior 12 months to inspect its adjusted free cash flow generation. This can be seen on page 30 of its presentation deck.

It shows that its TTM figure of 39.3% was even higher than the TTM adj. FCF margin in the prior quarter which was 38%. In other words, as revenue rises, the company is squeezing out more free cash as a proportion of its revenue.

Moreover, the company stated that this fiscal year it expects to make between 38% and 39% of revenue in adj. FCF. Very few companies can do this. It's mainly due to the strong recurring revenue and FCF that the company generates. This allows analysts to project its FCF.

It also implies that PANW stock could be worth significantly more. Let's look at this.

FCF Forecast and Price Targets

Analysts now project revenue for the year ending July 31 will be $10.53 billion and $11.93 billion for the following fiscal year. So, for the next 12 months (NTM), we can project revenue using 3/4ths of this fiscal year and ¼ of the next:

$10.53b x 0.75 + $11.93b x 0.25 = $7.8975b + $2.9825b = $10.88 billion NTM revenue

If we assume that adj. FCF comes in at 39.5% (i.e., the midpoint of the range given by management), FCF could hit $4.3 billion:

$10.888 billion x 0.395 = $4.2976 billion FCF

So, how will the market value this? In past articles, I have used a 35x FCF multiple. This is based on its market cap today of $128.7 billion and its TTM adj. FCF of $3.754 billion:

$128.7b / $3.754b FCF = 34.3x

Applying that multiple to the NTM FCF estimate:

$4.3 billion NTM FCF x 34.3 = $147.5 billion market cap estimate

This is +14.6% higher than today's market cap. So, the price target is about 15% higher:

$185.13 x 1.146 = $212.16

In other words, we can forecast that if Palo Alto Networks makes a 39.5% FCF margin, the market is likely to give the stock a $147.5 billion market value, or a price target of $212.

Analysts Agree

Analysts have even higher price targets than my FCF-based target. For example, Yahoo! Finance's survey shows an average of $224.53, which is 21% higher than today's price.

Similarly, Barchart's survey shows a mean price of $224.59, which is 21.3% higher.

And AnaChart shows that 33 analysts now have an average price target of $222.70, or +20% higher.

So, PANW stock looks undervalued here, and it could be worth between worth between 15% to 21% more.

However, there is no guarantee this will occur. The stock could languish at these levels.

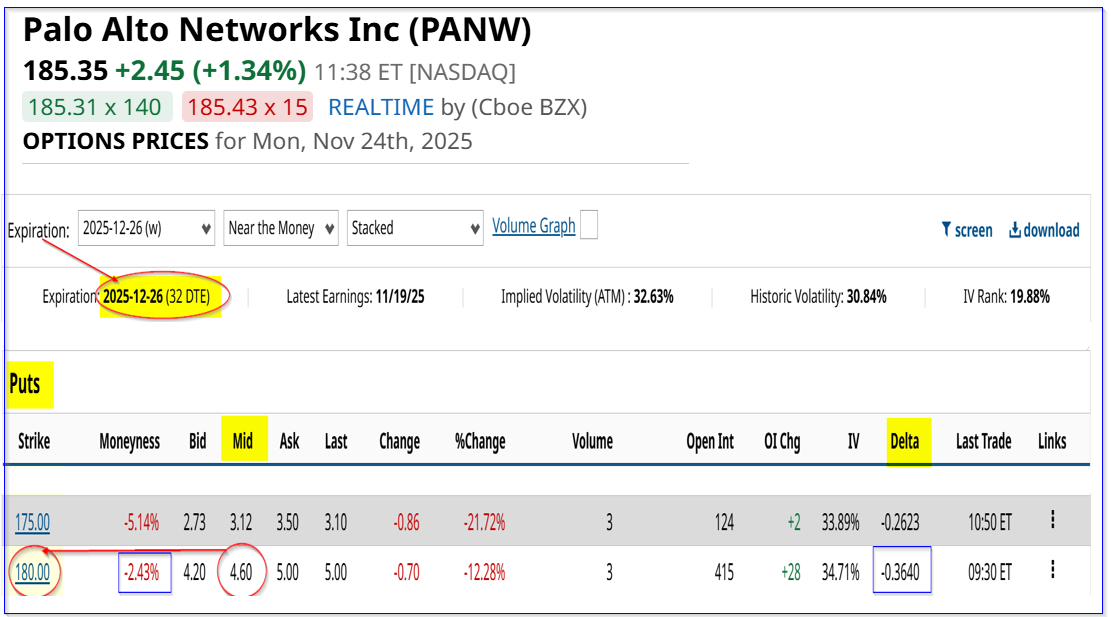

One way to play PANW is to sell short out-of-the-money (OTM) put options to gain extra income and set a lower buy-in point.

Shorting OTM PANW Put Options

For example, the Dec. 26, 2025, put option chain shows that the $180 strike price has a midpoint premium of $4.60 per put contract. That exercise price is 2.8% below today's price and provides a good potential entry point if PANW falls to that level.

Moreover, the investor gets paid handsomely. The strike price premium represents a one-month yield of over 2.55% (i.e., $4.60/$180.00).

Here is how that works. The investor first secures $18,000 with their brokerage firm. That acts as collateral in case PANW falls to $180 or lower, and the account is then assigned to buy 100 shares at $180.00 when the long put option holder exercises the option to buy at $180.00.

Then, after entering an order to “Sell to Open” 1 put contract at $180.00, the short-put account will immediately receive $460.00

So, the investment yield is 2.556% (i.e., $460/$18,000 = 0.02556).

Note that there is about a 36% chance that the stock could fall to this point. However, the investor's breakeven point, after accounting for the income, is lower at $175.40, which is $10 below today's price, or -5.36% lower. That provides good downside protection.

However, a more risk-averse investor could short the $175 put contract. That provides an immediate yield of 1.78% (i.e., $312/$17,500) and a lower breakeven point of $171.88, or -7.3% lower than today.

Given our price target of $212 per share, this means that any investor who shorts out-of-the-money PANW puts and is assigned to buy PANW shares at $180 or $175 could make an attractive return. They also get paid in the meantime each month while waiting for this to happen.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Under-the-Radar Tech Stocks to Buy as Nvidia Proves the AI Trade Has Staying Power

- Bridgewater Associates Just Bought QuantumScape Stock. Should You?

- Palo Alto Networks' Stock Has Tanked But Its FCF is Strong - Price Target is 15% Higher

- Should You Buy the 17% Pullback in Alibaba Stock Before November 25?